Improved UK winter cereal prospects: Grain market daily

Friday, 28 March 2025

Market commentary

- May-25 UK feed wheat futures lost £1.65/t yesterday following declines in most global grain futures and closed at a new contract low of £167.15/t. The Nov-25 contract also lost £1.65/t and finished trading at £185.60/t.

- Chicago grain futures prices came under pressure from expectations for Monday night’s report on US planting intentions and selling by speculative traders. Forecasts of rain for key wheat growing areas in the US and Russia was also a factor. Meanwhile, worries about EU export prospects and EU Commission forecasts for 2025 production weighed on Paris grain futures.

- The EU Commission’s first forecasts for 2025 show the wheat crop rebounding 13% year-on-year to 126.5 Mt, with barley output up 5% to 51.7 Mt. Maize production is projected at 65.0 Mt, up 10% from 2024. The rapeseed crop is also projected to rise 12% year-on-year to 19.0 Mt.

- May-25 Paris rapeseed futures rose another €8.00/t yesterday due to strength in global vegetable oil prices and closed at €521.00/t. This is the highest closing price for two weeks. The Nov-25 contract also gained €5.50/t and settled at €484.00/t.

Improved UK winter cereal prospects

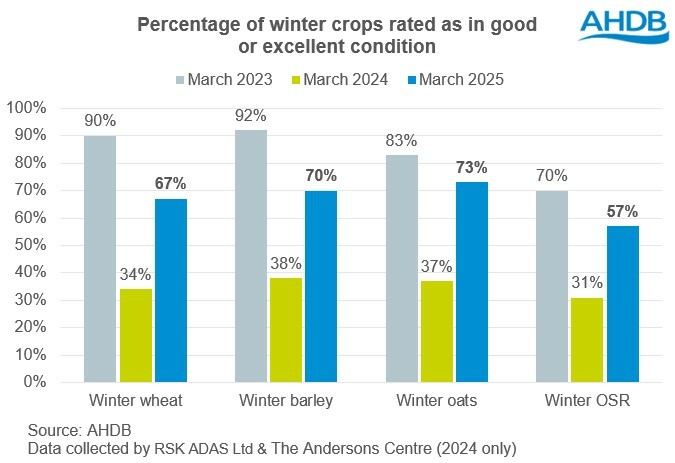

The latest AHDB crop development report shows that the condition of UK winter cereal crops is much improved from both November and this time last year.

Looking at winter wheat, at the end of March 67% of the crop is now rated as in a good or excellent condition. This is much improved from 44% at the end of November and 33% at this point last year. The good and excellent rating means crops have ‘normal’ or ‘above normal’ yield prospects.

However, crop condition scores, and so prospects, remain below some historical years. For wheat, 90% of crops had a good or excellent rating in March 2023 and in 81% March 2022.

Winter barley and oats also show similar improvements from November and last year, while remaining below 2022 and 2023 levels.

February had warm daytime temperatures that were favourable for winter crop growth. But night frosts slowed development, keeping winter crops more or less at a normal growth stage for this time of year. Overall, winter barley is ahead in growth, winter oats show little difference, and winter wheat is slightly behind compared to last year.

The weather conditions have also helped to control pests, weeds and diseases compared to last year’s warmer temperatures.

Contrasts for WOSR

In contrast to winter cereals, winter oilseed rape (WOSR) prospects have worsened overall since November due to pest damage, including from pigeons. Overall, 57% of WOSR is in a good to excellent condition at the end of March. While this is still above the 31% seen at this point last year, it is down quite notably from the 73% at end-November.

Oilseed rape crop condition is variable, but there is still potential for good yields where pests have not caused major damage.

Strong start to spring drilling

The weather has also enabled a strong start to spring drilling, especially on lighter land. In some regions of England, more than 70% of spring crops have already been drilled. Drilling progress has been limited in Scotland by soil temperatures remaining low.

The small areas of crops that have already emerged are doing well, though lower temperatures at times have slowed early growth.

Where next?

This suggests that winter cereal prosects at this stage are generally encouraging, though not as strong as some historical years. We’ll be able to offer more insights on spring crops, along with updated conditions for winter crops in our next report, scheduled for 2 May.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.