Human consumption bean market eroded by strong Aussie supplies: Grain market daily

Tuesday, 16 February 2021

Market Commentary

- Paris and UK wheat futures rose yesterday after Algeria issued a tender to buy wheat. The tender asks for wheat to be shipped to smaller Algerian ports, so could mean EU wheat has an advantage.

- There are also worries about cold weather in the US, which could result in some winter kill of winter wheat crops. US futures markets were closed yesterday because of a US federal holiday.

- May-21 UK feed wheat futures closed at £203.50/t yesterday, £3.00/t more than on Friday. The Nov-21 contract gained £1.50/t over the same period to £167.60, and Nov-22 futures rose by £1.50/t to £157.35/t.

- Australia will harvest 33.34Mt of wheat this season, its government said this morning, with harvesting nearly complete. This is an all-time record and 2.2Mt more wheat than it estimated in December. Its estimate of the barley crop was also increased by 1.1Mt to 13.1Mt (9.0Mt last year). The canola (rapeseed) crop is now estimated at 4.05Mt, up 0.35Mt from December (2.33Mt).

Human consumption bean market eroded by strong Aussie supplies

As we move towards spring cropping and in line with the challenges posed by OSR, many people will be looking at alternative crop options in both winter and spring slots of the rotation. Today’s focus is on pulse markets, with beans a possible alternative crop in place of OSR.

This week we will also be analysing trends in oat, UK soya and linseed markets

In December’s Early Bird Survey results, the area planted to pulses is shown increasing 7% year-on-year, to 249Kha. With this in mind, it is important to consider the path of bean prices as we move forwards.

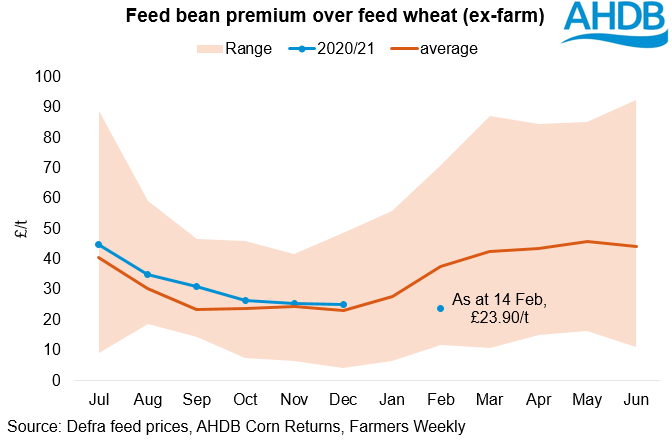

Through the tail end of last year, signs were showing that strong wheat prices were eroding the premium of beans over wheat. Prices published by Defra show that, in December, the premium of feed beans over feed wheat had dropped to £25.06/t, from £41.03/t a year earlier. This was the lowest since harvest ‘18.

This is not hugely surprising, given the large availability of beans this season relative to the tight wheat market. Although, there may be some support for feed beans from elevated values in other protein markets. In fact, year-to-December inclusions of feed beans in animal feed rations were up 22% on 2019/20, at 40Kt.

Anecdotal reports from the PGRO suggest that prices had firmed further in January and continued to look strong in early February. However, future price support will be heavily dependent on demand from feed compounders.

The human consumption (HC) market started the year under pressure, with export demand for UK crop almost entirely gone thanks to a bumper harvest in Australia. HC bean production in the South Pacific hit record levels this season, with production up 57.7%, at 516Kt (Abares). Trade between Australia and Egypt has reportedly been strong so far. This could add some support back into the HC market, as Australian exporters look to fulfil shipments, particularly with coronavirus led challenges in the container freight market.

However, a report by Saskatchewan Pulse Growers suggests that Egypt has purchased 220Kt of HC beans for import pre-April, more than in a normal year. This could cap future demand. Further forward, in the HC market coronavirus remains a concern, with a lot of HC bean consumption happening out of home in key export destinations.

The lack of HC trade is making it difficult to price new crop HC beans. Feed beans premiums are reportedly ahead of the 5-year average of the Defra figures for November (£25/t).

As with all cropping decisions, it is vital to know your end market as well as for agronomy. Better awareness of demand patterns gives increased insight into prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.