How strong will EU wheat imports be this season? Grain market daily

Tuesday, 21 February 2023

Market commentary

- May-23 UK feed wheat futures closed at £241.10/t yesterday, down £0.15 from Friday’s close. The Nov-23 contract gained £0.20/t over the same period to close at £237.10/t. UK and Paris wheat both traded at a narrow range on Monday due to the US market’s being closed.

- Further to that, there was little change as cheap Black Sea supplies continue to pressure prices but are balanced by ongoing speculation over the future of the grain corridor deal.

- Paris rapeseed futures (May-23) fell €7.00/t from Friday’s close, to settle at €557.50/t yesterday.

- Yesterday, the European Union’s crop monitoring service highlighted a lack of rain in southern areas of Europe including France, Italy and Spain as a cause for concern ahead of the spring growing season. Something to watch as we move through the season.

- A new article: Understanding regulated carbon markets, has been published on our carbon market webpage.

How strong will EU wheat imports be this season?

Competitive supplies from Ukraine to Southern regions of Europe, combined with the impact of dry conditions at the end of last season (2021/22) have meant EU wheat import demand has been strong so far this season. However, Stratégie Grains said in their February grain report that they are expecting the pace of EU imports to slow down throughout the rest of the season. This comes as Black Sea exports coming through the secure shipping corridor seem to be losing momentum, and EU feed demand remains subdued.

With on average 92% of UK wheat exports going to the EU over the last 5 years, and a large domestic exportable feed wheat surplus this year, it’s important to monitor the pace of domestic wheat exports to the EU, as they could be a potential consumer of this surplus.

EU imports

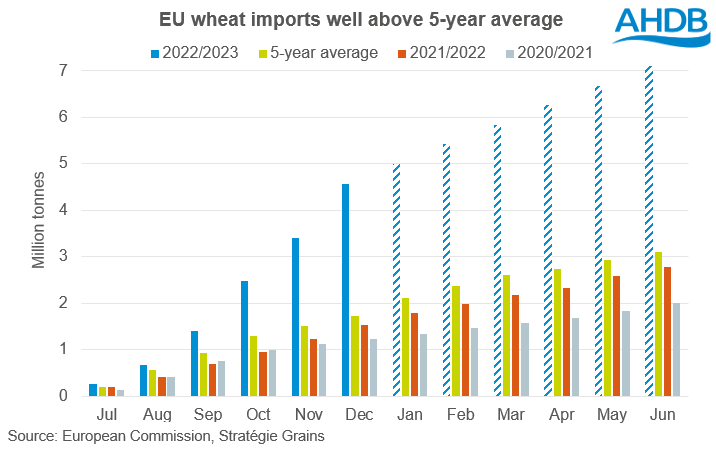

Using data from July to December 2022, EU wheat imports (excl. durum wheat) have totalled 4.6Mt so far this season, more than double the five-year average at this point in the marketing year, and up 198% on the year. Looking over the remainder of the season, Stratégie Grains have pegged their 2022/23 EU wheat import estimate at 7.1Mt, if realised, this would be up 4.3Mt on the year.

Using import data so far this season, and the estimate from Stratégie Grains, we can calculate an average import figure for the last six months of the year. In order to reach the estimate, the EU would need to import just under 421Kt of wheat a month, much lower than the average monthly import figure for the first six months of the season.

What does this mean for UK wheat?

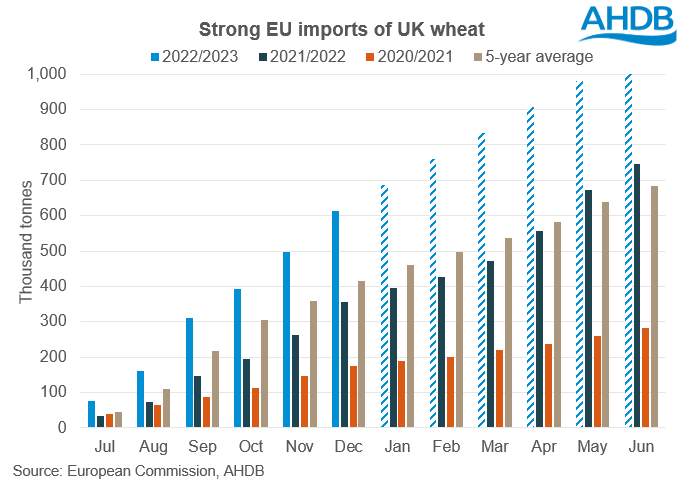

The latest EU customs surveillance data (until 06 February), shows that 16.1% (831.2Kt) of imported wheat (excl. durum wheat) in the EU was from the UK so far for this marketing year, only behind Ukraine as a top import origin.

In the first half of this season, according to European Commission data up to December 2022, the EU imported 613.3Kt of UK wheat, up 73% on the year, and up 48% on the five-year average. If we take AHDB’s 2022/23 wheat export estimate (1.15Mt) from our January supply and demand estimates, and calculate the average percentage that has gone to the EU over the last 5 years (91.6%), we can then indicatively estimate how much of those wheat exports are likely to go to the EU (1.05Mt).

For the UK to finish the season having exported over 90% of our wheat to the EU, we would need to export an average tonnage of just over 73Kt a month for the rest of the season to the EU. Currently, the average monthly export figure so far this season is 102.2Kt, indicating that the pace may slow.

However, this will ultimately depend on the price of our domestic wheat. Yesterday, UK feed wheat futures (May-23) closed at £241.00/t, while Paris milling wheat futures (May-23) closed at £258.45/t. The UK market is currently trading at a healthy discount to Paris but faces competition from other origins such as Ukrainian wheat, which is at a larger discount. So far this marketing year 62.6% (3.2Mt) of imported wheat (excl. durum wheat) in the EU has come from Ukraine.

To conclude, even if EU imports ease slightly as expected over the remaining six months of the season, demand from the EU is still historically strong, and even if our export pace slowed it would have to decline considerably to be below the current estimate. Increased exports will mean less wheat will be carried into the next season. At the end of the day this will all be dependent on the UK’s discount to the continent, price competitiveness to other origins and what happens to the renewal of the export corridor.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.