How much could oilseed rape area increase in harvest 23? Grain Market Daily

Friday, 15 July 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £269/t, down £6.30/t on Wednesday’s close. The May-23 contract closed at £275.35/t, down £4.50/t over the same period.

- New crop futures (Nov-23) were also pressured, closing at £238.25/t, down £3.10/t on Wednesday’s close.

- Global wheat markets fell on positive signs of Ukrainian grain being exported from the Black Sea. Russia, Ukraine, Turkey and the United Nations are due to sign a deal next week.

- The prospect of achieving high wheat yields this season looked good up until the start of July in the UK - and this morning we have released the latest crop development report, click here for further insight and analysis.

How much could oilseed rape area increase in harvest 23?

With the UK harvest now starting and expected to ramp up in the coming weeks, focus starts to turn towards what could be sown for harvest 2023.

With Paris rapeseed futures (Nov-22) closing yesterday at £673.50/t, prices are still historically high. Could this high price increase the appetite of growers to plant more OSR for harvest 2023?

Market outlook supporting OSR

The UK has had declining OSR area over recent years due to the challenges around growing the break crop. However, the gradually-elevating market over the last 18 months has outweighed and mitigated some of the risks of growing OSR, with potential loss of yield being offset by the high prices.

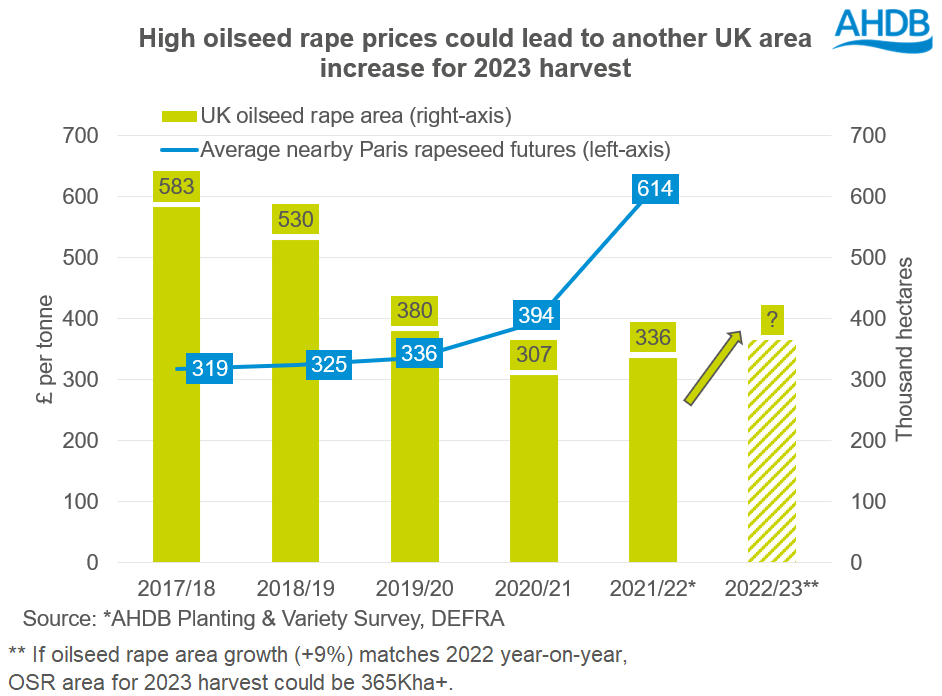

In the 2020/21 marketing year, nearby Paris rapeseed futures averaged £394/t, up from £336/t in 2019/20. Off the back of this high-priced year in summer 2021 there was an estimated 359Kha planted (AHDB Early Bird Survey).

In the latest data released in the AHDB planting & variety survey the area is estimated at 336Kha, indicating a c.6% area loss from the end of 2021. In the regional breakdown of this survey, we can see areas such as Yorkshire and Humberside and the East Midlands increase their OSR plantings. This is mainly at the expense of sowing oats.

The 17% increase year-on-year (2019/20 to 2020/21) in average nearby Paris rapeseed futures prices led to a 9% increase in OSR area for 2022 harvest. However, prices in the 2021/22 marketing year have averaged a staggering £614/t, a 56% average price increase on the year. Even if that were to mean that the2022 increase of 9% was matched, we would be looking at an area of over 365Kha. However, the scale of the increase in prices year on year might mean that this rise in area could be even higher.

Could OSR area increase?

Anecdotally, it has been reported that area will increase but this will vary regionally. Higher prices are tempting some growers back to the game after years away from growing OSR. It’s reported that some are taking the punt at growing the crop in a more cost-effective way (i.e. using fewer inputs) and redrilling with winter or spring crop if it fails.

Furthermore, it could likely be the case that, due to the absence of OSR in the rotation over previous years, there is scope to grow larger areas should producers want to do that.

Conclusion

It is likely the high price will attract growers back to OSR, as if successful it’s currently a high margin and effective break crop. For instance, our latest gross margin work ranks OSR at fourth place for harvest 2023, read more here. On the flip side if it is not successful, it can be an expensive failure.

Weather in August will be key with rains needed to help establishment. If you are choosing to grow OSR again be sure to consider mitigating the risk of price volatility by taking advantage of high prices now. For instance, with the anticipation of a larger Canadian crop we could possibly see rapeseed prices premium reduce and plus there is the possibility that the rapeseed market could also be more influenced by the soyabean market in the future.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.