Will soyabeans influence rapeseed prices in 2022/23? Grain market daily

Tuesday, 28 June 2022

Market commentary

- UK feed wheat futures (Nov-22) closed yesterday at £271.50/t, down £2.75/t on Friday’s close. The May-23 contract fell by the same amount yesterday, closing at £278.00/t. The Nov-23 contract closed at £242.30/t, down £0.70/t on Friday’s close.

- The domestic market has followed the Chicago and Paris markets down. Reason for this pressure is the expanding wheat harvest in the northern hemisphere, and lack of demand for U.S. origin. In the US what direction prices will take next seems to be curbing demand despite harvest progressing.

- In the latest USDA crop progress report, U.S. winter wheat harvest (as at Jun 26) is estimated 41% complete, up 16 percentage points (pp) on the week before. This is ahead of the five-year average of 35%.

Will soyabeans influence rapeseed prices in 2022/23?

Yesterday’s market report showed global grain and oilseed prices saw pressure over the last week. There are several factors that have been driving this, including concerns over a global recession, progress in Northern Hemisphere harvests, and US spring crops faring well.

The most sizable drop across the week was seen in domestic delivered rapeseed prices (into Erith, Hvst-22) in the AHDB delivered survey. This saw a weekly drop of £90.50/t to be quoted at £566.00/t on Friday (24 June).

The drop has been sizable, but in historical terms, prices remain high. However, with rapeseed stocks marginally recovering for the 2022/23 marketing year could we see rapeseed prices more influenced by the soyabean market?

Global rapeseed stocks to recover slightly

Over this marketing year (2021/22), rapeseed prices have sat at a healthy premium to soyabean prices. Even before the Ukraine-Russian war, we were in short supply of rapeseed, as global stock-to-use ratios dropped to 5.9%, down from 8.1% in 2020/21.

As we start the 2022/23 marketing year, the USDA’s latest figures estimate that global rapeseed production will increase to 80.8Mt. This is up from 71.4Mt in 2021/22 and higher than the five-year average at 72.5Mt.

This higher production is being met by higher consumption, which is to increase by 7.2% on the year (to 78.4Mt). Despite this, for 2022/23 global stocks-to-use ratios are going to increase year-on-year to 7.7%, nearer to 2020/21 levels at 8.1%. However, down on the five-year average of 10.1%.

The relationship between rapeseed and soyabeans

With this increase in rapeseed for the 2022/23 marketing year, we could see rapeseed prices have more of a correlation with soyabean prices.

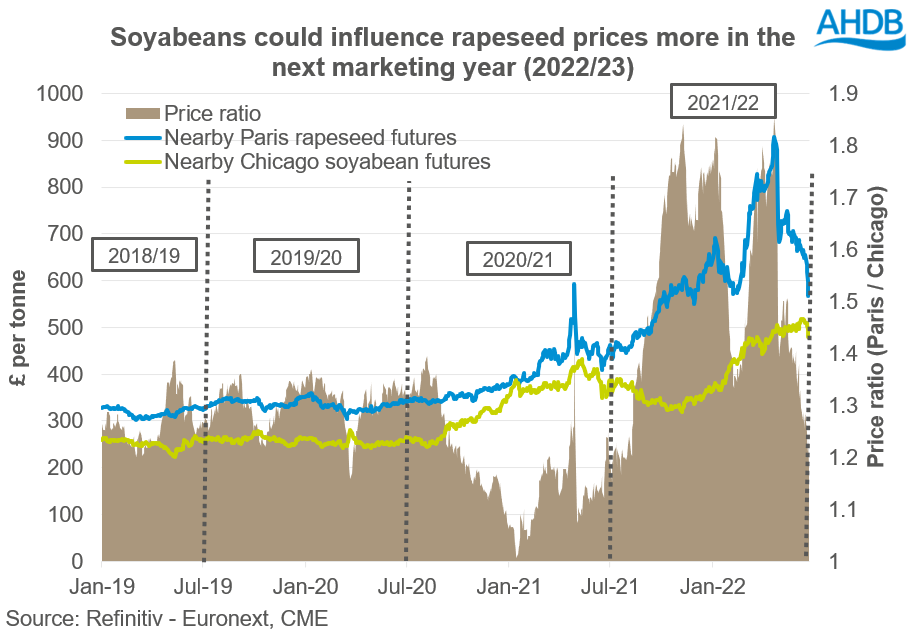

As displayed in the graph, over the 2019/20 marketing year the average price ratio between rapeseed and soyabeans on average was 1.31x.

In the 2020/21 marketing year this ratio dropped slightly to 1.18x, as La Niña dryness in South America supported the soyabean market towards the end of the 2020 calendar year.

However, in the 2021/22 marketing year we have seen this relationship totally disjoint as the price ratio averaged 1.53x, and at times was as high as 1.86x.

Conclusion

Based on historical pricing, rapeseed prices could be more influenced by soyabeans going into the 2022/23 marketing year.

Recently we have seen oilseed prices drop, and with global stock-to-use ratios forecasted to increase for rapeseed, soyabeans could influence the sentiment of rapeseed prices more and impact farm gates prices.

This is withstanding that there isn’t a major weather event in Canada or Australia between now and January 2023.

Key watch points in soyabean markets over the next 6 months include:

- US soyabean production - 98% is planted (as at 26 June) weather in the U.S. Midwest is a key watchpoint until the end of 2022 to ensure the crop fares well and are harvested. The latest crop progress report estimated 65% of soyabeans are rated good-to-excellent as at 26 June, down 3pp from last week, conditions are a watchpoint.

- South American planting intentions and progression - focus will be on Brazil and Argentina from October 2022 considering high input costs.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.