How is the war in Ukraine impacting rapeseed exports? Grain market daily

Wednesday, 28 September 2022

Market commentary

- UK feed wheat futures (Nov-22) closed at £288.00/t yesterday, up £0.50/t on Monday’s close. The Nov-23 contract closed at £273.75/t, up £2.00/t over the same period. This followed wider global wheat contracts up.

- Paris rapeseed futures (Nov-22) closed at €602.75/t, gaining €14.25/t from Monday’s close. Prices tracked support felt in the Canadian markets following limited selling of farm stocks and worries of lower Canadian yields (Refinitiv).

- This morning the sterling has reversed yesterday’s slight gains, as the Bank of England announced they would intervene in bond markets. At 12pm, the pound was trading at £1=$1.0579. This continues the trend of a weak pound against the dollar following the government announcement of large tax cuts on Friday.

How is the war in Ukraine impacting rapeseed exports?

The conflict between Russia and Ukraine remains a key factor driving grain and oilseed prices, continuing to provide underlying support to markets.

Global trade dynamics have been impacted as a result, with the flow of grains and oilseeds leaving Ukraine initially restricted. Though an export deal was established in July. The Istanbul Agreement allows exports from the Black Sea grain corridor for 120 days from 22 July until the end of November.

Since the establishment of this deal, the flow of exports has been gaining strength. According to UkrAgroConsult, agricultural exports from 1-18 September totalled 3.9Mt. Of this, 2.0Mt left Odessa (including maize, wheat, rapeseed, and vegetable oils). Total September exports of agricultural goods may even reach record levels of 5.5 – 6.0Mt. If realised, this could be over the previous September 2019 record of 5.8Mt (according to UkrAgroConsult).

So, what is leaving Ukraine and where is it heading? Today’s grain market daily looks at Ukrainian rapeseed.

Ukrainian exports to the UK – looking at previous seasons

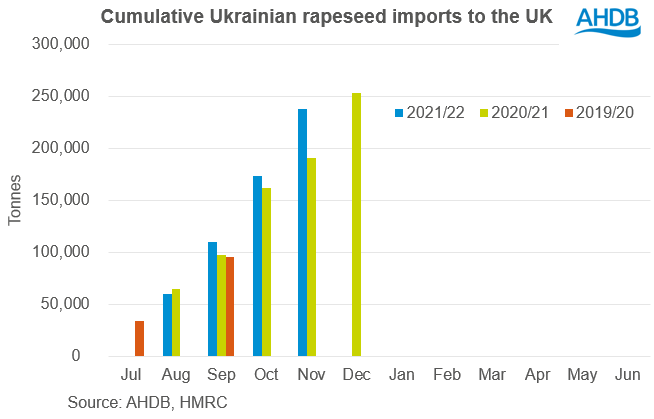

The UK began importing rapeseed from Ukraine in the 2019/20 season. Ukraine front loads its rapeseed exports at the start of the season. This is seen during the 2020/21 and 2021/22 seasons, when the UK imported rapeseed from Ukraine from August to December.

In HMRC data released for July 2022, the UK has not yet recorded any Ukrainian imports into the UK. Perhaps not surprising considering previous season’s import patterns, though can we expect any to be seen in August/September figures?

In July, HMRC data shows 24.6Kt of rapeseed was imported from the EU, mainly from Belgium, France and Spain. This compares to 70.8Kt in July of last year.

Where is Ukrainian rapeseed currently going?

For total exports (including rail and road), the UkrAgroConsult report that 784.8Kt of rapeseed had been exported in July and August. This is only 5.9% behind last season (July to August).

According to the United Nations, as at 27 September, 399.6Kt of rapeseed had left Ukraine by port (from Odessa, Chornomorsk, Yuzhny/Pivdennyi). This was recorded to The Netherlands, France, Romania, Belgium, Germany, and Portugal.

According to European Commission customs surveillance data, as of 25 September, a total of 809.2Kt of rapeseed had been imported to the EU from Ukraine (as total movement) so far this marketing year (2022/23). This accounts for over half of all EU imports of rapeseed for 2022/23 season to date. If realised, these numbers confirm a continued flow of rapeseed exports into the EU. And as we have seen in UK figures to date, some EU rapeseed continues to move into the UK (albeit lower than last season).

What will happen in the coming months?

Ukrainian rapeseed imports, over the last 3 full seasons, accounted for an average of 31.5% of total UK rapeseed imports and therefore are significant to follow. We can see that Ukrainian rapeseed exports continue to the EU, and some imports continue to flow from the EU into the UK. Though no direct movements from Ukraine have been seen in UN data yet (to 27 Sept).

The situation in Ukraine continues to be watched closely, following the referendums in occupied Ukraine and the calling up of Russian reserves. The established grain corridor will be key to continue the flow of rapeseed leaving Ukraine, and therefore rapeseed available on the continent. If we see this squeezed, we could see rapeseed prices supported in the EU and UK.

Though other factors too will be key to watch going forward for UK imports of rapeseed, including exchange rates making imports more expensive, and demand considering recessionary concerns.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.