How high can rapeseed go? Grain Market Daily

Wednesday, 11 September 2019

Market Commentary

- UK feed wheat (Nov-19) futures continued their positive move yesterday gaining £0.85/t to close at £135.00/t. Yesterday’s move saw wheat futures close above the 20-day moving average for the first time since late July.

- The latest rally continues to see wheat futures move against the path of sterling.

- On Thursday the USDA will release its latest supply and demand estimates. Meanwhile a meeting of the European Central Bank is expected to result in a cut to ECB interest rates and a subsequent weakening of the euro.Both reports will be watched closely for their impact on global and EU pricing.

How high can rapeseed go?

- Rapeseed production in the EU down 13% year-on-year.

- Rapeseed oil prices high but competitor oil prices holding steady, potentially reducing demand.

- Australian canola production suffering from the heat.

Oilseed rape prices, both EU futures and UK physical have seen some significant growth on the back of supply woes over the past couple of months. EU OSR production is now forecast at 17.5Mt by the EU commission, a 13% fall year on year.

While supply tightness has driven prices higher, logic dictates that prices can’t rise forever. At some point the fundamentals will all be factored in, and OSR will price at such a point that disincentives demand. But where is that point and what will drive it?

Oil prices

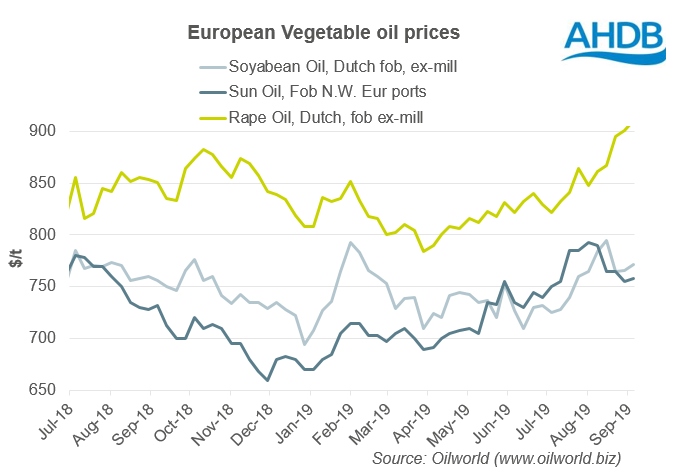

The main catalyst of a reduced demand for oilseed rape is likely to come from the recent surge in prices of rapeseed oil. While rapeseed oil prices have been climbing of late, prices of competitor oils have stagnated.

Sunflower oil and soyabean oil now discount to rapeseed oil by $143/t and $129/t respectively. Moreover, the price of sunflower seed (CIF, Rotterdam) has also fallen considerably away from rapeseed.

At such levels the incentive to crush sunflower seed instead of rapeseed is likely to increase, capping demand and prices for rapeseed. The EU is forecast to crush an additional 542Kt of sunflower seed and an extra 690Kt of soyabeans this season (EU Commission).

Southern Hemisphere

With the loss of potential support for oilseed rape prices from a switch into other oils, production in the Southern Hemisphere will also be watch closely for future price direction. Yesterday Grain Market Daily, Peter highlighted the current dryness challenges for Australian wheat.

Dryness in the country is equally a concern for its canola crop. Production of canola in Australia is forecast at 2.3Mt, up on the year, but 29% below the 10 year average.

The Australian crop is a key import crop for the EU and as such will be an important influencer of OSR prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.