How are crop conditions faring as we near harvest? Grain Market Daily

Friday, 7 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £194.90/t, gaining £0.40/t from Wednesday’s close. Nov-24 futures closed at £198.80/t, gaining £0.45/t over the same period.

- Paris milling wheat futures ended mixed yesterday but only marginally changing while trader’s assess harvest and export prospects.

- There was pressure across the board for Chicago wheat futures in a technical and profit-taking retreat, after surging up on Wednesday, with weak US export demand anchoring the market.

- The grain market remains underpinned by weather risks to northern hemisphere crops, though attention is starting to turn back to export competition from Russian supplies. Agricultural consultancy Sovecon raised its forecast for Russia’s 2023/24 wheat exports to 47.2 Mt from 45.7Mt previously.

- Paris rapeseed futures (Nov-23) closed yesterday at €451.50/t, down €4.75/t from Wednesday’s close. Rapeseed followed Chicago soyabeans down, which retreated in a profit-taking pullback from the recent support. Further to that, there is forecasts of rains and mild temperatures in much of the US Midwest aiding crop development.

How are crop conditions faring as we near harvest?

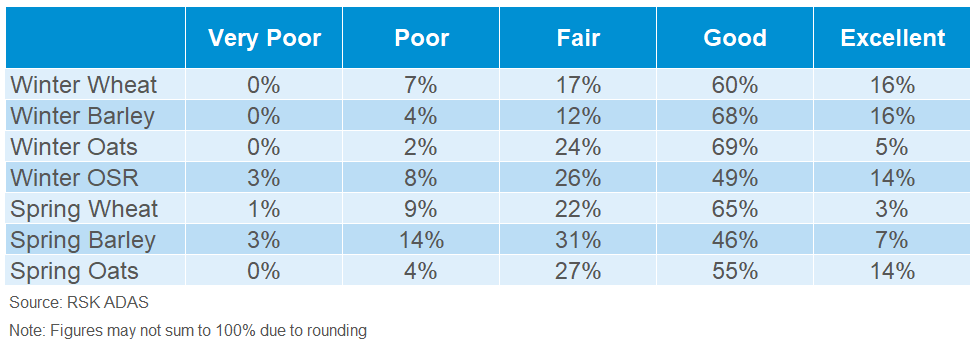

Earlier today, we released our latest GB crop development report, using data as at the week ending Tuesday 04 July.

In general, from last month’s crop development report grain and oilseed crop conditions remain relatively unchanged as we near harvest.

The end of June saw more unsettled conditions and cooler temperatures. Cooler weather has reportedly slowed senescence, and grain filling is looking good for winter wheat and OSR. Some areas experienced localised heavy rainfall, increasing lodging risk for some crops. Some lodging around headlands and fertiliser overlaps has been noted because of heavy rains, particularly for winter barley. However, overall, it is reported only a very small area of the cereal crop has been affected (less than 1% in most regions).

Key watch points going forward are leaning in some winter barley crops which will be watched closely should there be further heavy rain. Some winter wheat crops where PGR applications were applied late, or during unfavourable weather conditions, also have an increased risk of lodging.

There has been reports that disease pressure remains high in places, though recent rains are not considered likely to cause further problems in winter crops, considering the crop development stage. With heavy rain mostly post-flowering for many, ergot is reportedly unlikely to be a major problem.

Grass weeds are also reportedly troublesome, with bromes more prominent this year in most areas. This might be linked to dry weather late summer into autumn 2022 limiting the autumn weed flush, as well as shallower cultivation methods.

It’s reported that winter cereal crops are generally in good condition, as harvest nears. Key watchpoints remain weed infestations, as well as crops which suffered from drought conditions especially in lighter soils. Lodging remains a key watchpoint for winter barley, though harvest is imminent, with combines expected to be starting up for winter barley next week. Winter wheat harvest is expected to start early August.

Spring cereal crops remain variable in development, down to drilling date and soil type especially. Later sown crops are reportedly struggling from dry weather, something to watch closely for yield prospects.

Winter oilseed rape crops remain variable, especially from CSFB damage. Desiccation is beginning, and harvest is reportedly expected to begin across regions in the south, east and midlands in the week commencing 17 July.

For more information by crop type and interactive dashboards, please follow this link.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.