Higher retail prices lead to increased spending on pig meat

Wednesday, 4 March 2020

By Bethan Wilkins

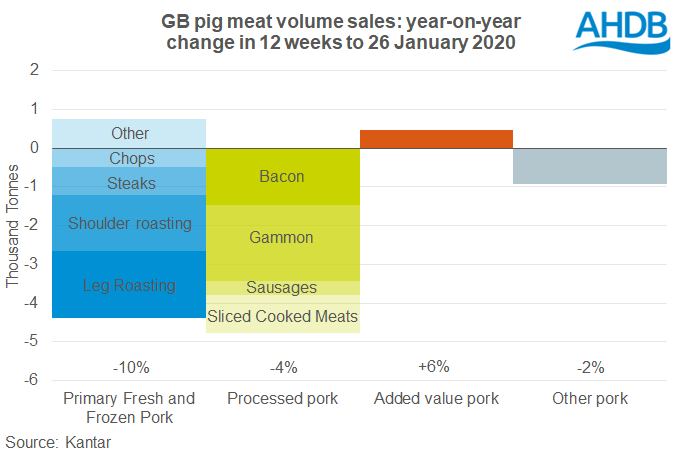

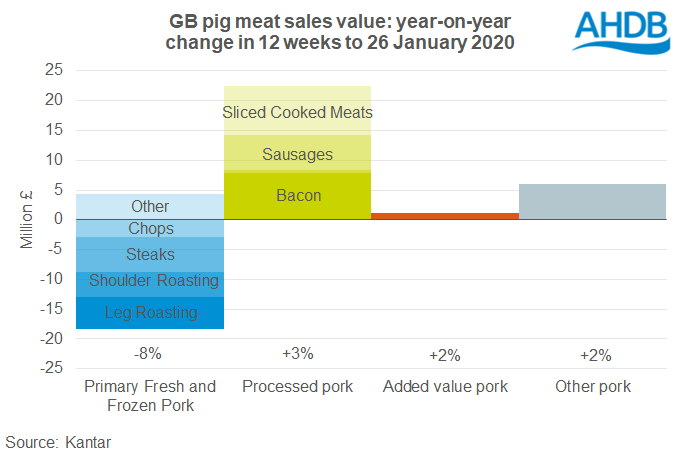

In the 12 weeks to 26 January, the latest Kantar data shows that spending on pig meat* at retail level increased slightly (+1%) compared to the period last year.

This was driven by a 5% increase in average prices, partly due to a reduction in promotional support for both primary pork and bacon. Prices have been rising significantly further up the supply chain. GB pig prices were 17% higher than year earlier levels in January, and the price of imported pig meat was also up by 17% in December. This may well be pressuring retail margins, encouraging some price increases.

The amount of pig meat purchased declined by 4%, mainly due to consumers each purchasing less. Despite this period covering an increasingly visible “Veganuary”, market penetration across the 12 weeks was similar to last year.

Though the overall picture was not unreasonable, primary pork continued to suffer. Fewer people bought pork, and the volume per buyer declined.

Increased spending on processed pig meat enabled the overall rise. This category still lost a few shoppers though, and volume per buyer fell.

Overall market penetration was maintained due to some growth from the “added value” segment, which includes “ready-to-cook” and sous-vide products.

*total pig meat includes primary pork, chilled main meal accompaniments, ready meals, ready-to-cook, sausages, bacon, burgers & grills, sliced cooked meats

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.