Heatwave expected in Europe as yield expectations dip: Grain market daily

Tuesday, 25 June 2024

Market commentary

- UK feed wheat futures (Nov-24) closed at £195.35/t yesterday, down £1.55/t from Friday’s close. The May-25 contract fell £1.60/t over the same period, to close at £202.95/t.

- Global wheat markets were pressured as the US winter wheat harvest shows strong pace at 40% complete (as at 23 June), up 19 percentage points from this time last year and 15 percentage points from the five year average. In addition, while recent yield data in Russia is not totally indicative of the whole wheat crop, initial yields have been high and are said to have lowered Russian wheat export prices (Reuters).

- Paris rapeseed futures (Nov-24) closed at €471.00/t yesterday, down €0.75/t from Friday’s close.

- Competitively priced sunflower oil weighs on the wider vegetable oils complex. Russia, Ukraine and Argentina have offered lower priced sunflower oil than soyabean oil and palm oil, contrasting the historical premium sunflower oil usually holds.

Sign up to receive the Weekly Market Report and Grain Market Daily from AHDB.

Heatwave expected in Europe as yield expectations dip

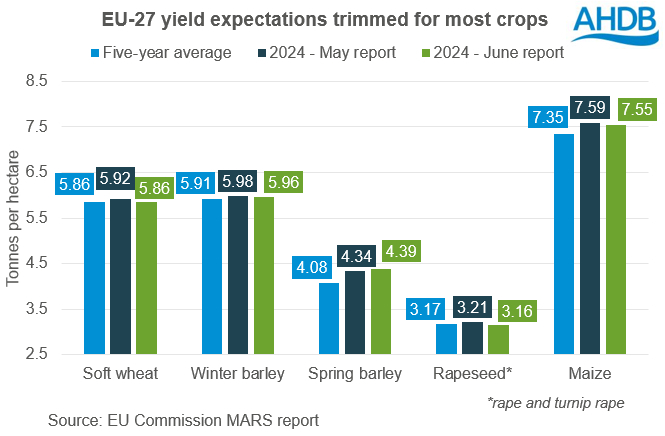

The EU Commission’s MARS report trimmed its forecasts of EU crop yields yesterday, due to both overly wet and overly dry conditions in different parts of the bloc.

The report trimmed its predicted average EU soft (exc. Durum) wheat yield from 5.92 t/ha in May to 5.86 t/ha this month. This is now in line with the five-year average. Yield prospects for winter barley, rapeseed, maize and sunflowers were also reduced. The forecast for spring barley yields was edged up slightly.

Continued wet weather in parts of France and Germany, plus the Benelux countries has slowed crop growth and farmers’ ability to carry out field work. Pest and disease pressure is said to be high. The weather has also greatly slowed spring crop planting and root growth is a concern.

Meanwhile, dry weather had a negative impact on winter crop prospects in parts of Hungary and Romania. Heatwaves also negatively impacted Spanish winter crops in June, though prospects remain positive overall.

Conditions also remain positive in Poland and northern and eastern Germany. Soil moisture levels are starting to decline, but for now, no adverse effects are reported. The forecast rain for this week would be a positive. The outlook for Denmark and Sweden is also improved after a wet winter.

The report also highlights the impact of continued dry weather on winter yield prospects for Russia and Ukraine, something to keep an eye on.

A heatwave forecast

A heatwave is now expected across much of Europe this week. This is likely to be welcome for crops which have so far been negatively impacted by continued wet weather, especially in key producers France and Germany. The change in weather would help winter crops ripen by providing much needed radiation or help dry down for those approaching harvest.

However, the warmer temperatures could have a strong negative impact on spring crops. Maize and sunflower crops in parts of eastern Europe and the Balkans are said to be most at risk (LSEG). The duration and intensity of the heatwave could prove key to its impact of crops and therefore prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.