Have you thought about marketing harvest 2024? Grain market daily

Wednesday, 29 March 2023

Market commentary

- UK feed wheat futures (May-23) closed yesterday at £208.50/t, gaining £0.50/t on Monday’s close. New crop futures (Nov-23) closed at £219.05/t, gaining £0.05/t over the same period. The gap between old and new crop closed slightly.

- Wheat markets were mixed yesterday with the Chicago market gaining on US drought concerns and as traders squared positions before Friday’s annual USDA planting intentions report. In the Paris market, there was pressure from ongoing competitive Russian exports.

- Paris rapeseed futures (May-23) closed at €471.75/t yesterday, unchanged on Monday’s close. This is despite the Chicago soyabean market gaining from technical trading and continued Argentinian drought.

- Buenos Aires Grain Exchange maintained both their 2022/23 production estimate for soyabeans (25Mt) and maize (36Mt) last week, but cautioned further cuts were possible with initial yields coming in lower than expected.

Have you thought about marketing harvest 2024?

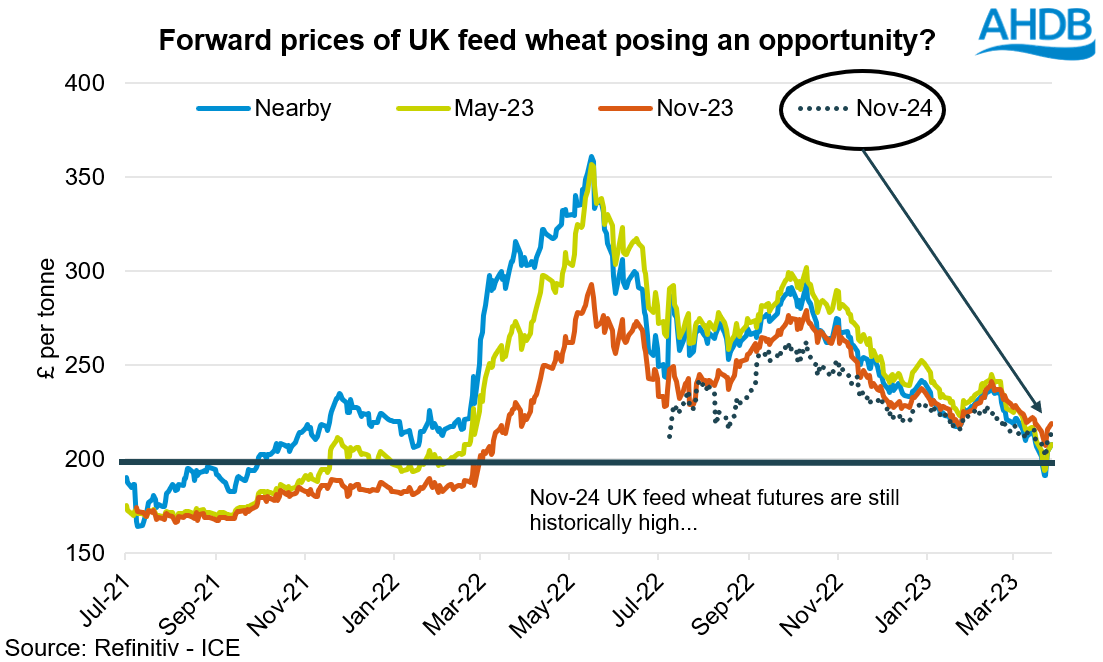

There has been a change in the dynamics of our domestic market recently, with old crop futures trading at a discount to new crop prices. Based on yesterday’s close, Nov-23 and Nov-24 are at a £10.55/t and £4.20/t premium, respectively, to May-23 futures.

The overall sentiment is bearish at the moment for wheat prices, both short and long term. Though that is withstanding the volatility which is expected given war ongoing in Ukraine.

In recent months, cheap Black Sea supplies have weighed on global wheat prices, especially for old crop wheat. New-crop contracts have seen pressure, though arguably not to the same degree. As such, have you considered marketing part of your 2024 crop? With energy prices, notably natural gas and crude oil, falling from the peaks in summer 2022, and GB fertiliser prices softening, input costs look to be falling slightly too. Combined with the fact that when we get to 2024 harvest the world geo-politically may be significantly different, how will this alter prices?

Currently traded volumes on ICE UK wheat futures (Nov-24) have been very limited, but the contract is still trading at historical highs, despite dropping significantly in recent months. As displayed in the graph below, Nov-24 is trading above the £200/t mark and at a premium to May-23 futures at the moment.

This isn’t an article to say forward sell all your grain for harvest 2024, but instead think about these forward prices against your costs, this also applies to harvest 2023 where you will have a good idea of your costs. Forward prices remain historically high, and even before the war in Ukraine, UK feed wheat was approaching £200/t from Sep-21 from a tighter global supply and demand balance.

When we get round to harvest 2024 £200/t+ may not be there…alternatively if £200/t is the worst deal you make for harvest 2024, would you be annoyed?

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.