Have we reached the bottom of the sow market?

Wednesday, 12 August 2020

By Bethan Wilkins

Cull sow prices in the EU have fallen particularly sharply in recent weeks, surpassing the declines seen in the finished pig market. This is not surprising, considering the closure of a key processing plant in Germany, which limited available capacity. As the more valuable market, with a less flexible slaughter window, finished pigs were understandably prioritised.

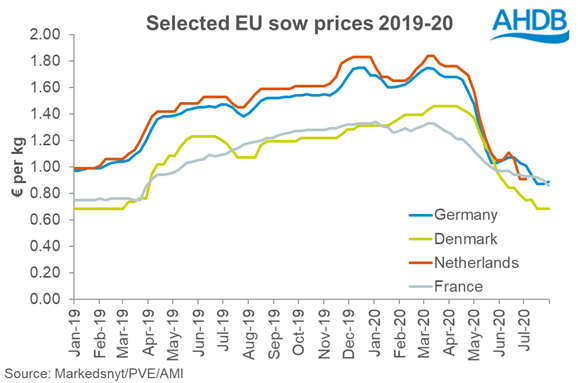

In Germany, the key market for sow meat in the EU, the price for an M1 grade sow had been nearly €1.70/kg in April. The sow price fell to around €1.00/kg by early June, reflecting declining demand due to the coronavirus pandemic damaging demand. In July the disruption to processing capacity led to a further fall in the price, taking it under €0.90/kg. This was the lowest level on records going back to 2014.

Prices elsewhere broadly followed the German trend. French and Dutch quotes also fell by over 10% between the start of June and end of July, to stand at €0.86/kg and €0.92/kg respectively. Dutch prices were not published for much of July, probably reflecting limited processing taking place.

Although prices on all the key markets were similar at the start of June, Danish prices have since fallen more sharply, losing nearly 25% over the past 8 weeks. At €0.69/kg, the Danish price is the lowest it has been since early 2019.

In Britain, reports indicate that prices have also fallen, with less trade taking place on the back of limited demand. For the four weeks to w/e 11 July GB estimated sow slaughter was nearly 20% lower than last year, though it seems numbers have since largely recovered.

EU sow prices have been more stable in the past couple of weeks, even posting a slight uplift in Germany. The key German processing facility has now reopened, which eases some of the market pressure. Chinese importers are reportedly also ordering large quantities of pork, while hot weather on the continent is slowing pig growth rates and boosting demand for barbeque items. While these signs are optimistic, Germany is still reporting that finished pig supplies are ahead of demand levels, so it might be too much to expect a significant uplift feeding through to our sow prices soon.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.