Have milk price increases covered higher input costs?

Thursday, 17 February 2022

Currently, high input costs are challenging dairy farm margins, although we have also seen milk prices move up to help offset them. The question is to whether the increases in milk prices have been enough to cover the additional costs. The analysis is based on industry averages. While every farm will have different cost structures, and be more exposed to particular cost categories, looking at average values can set out the degree to which margins may be coming under pressure.

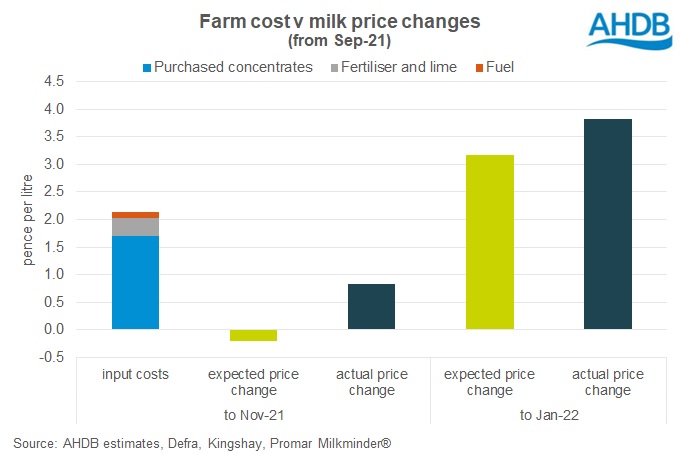

Our latest production cost estimates measure costs for the 12 months to Sep-21, with feed, fuel and fertiliser[1] estimated to total 13.3ppl. Of the total cash costs of production, purchased concentrates accounted for 37%, while fertiliser and fuel each accounted for 3%. Using monthly changes to these three cost categories, average cash costs are estimated[2] to have risen by 2.1ppl in the 2 months to Nov-21 (the latest month in which we have published data).

Over the same period (Sep-21 to Nov-21), milk prices rose by 0.8ppl. As markets had been relatively stable up to that point, and milk prices typically lag the market by 3-4 months, this was roughly in line with the change in the market value for milk and dairy products.

However, by Jan-22, milk prices moved up a further 3.0ppl from Nov-21 levels, as higher market returns started to flow through. Increases in wholesale prices for butter, skimmed milk powder (SMP) and cheese improved the market value for milk (MMV) between Sep-21 and Jan-22, justifying milk price increases of 3.2ppl in total over this period. These improved market returns appear to have accounted for almost all of the milk price increases made over the 5-month period, which totalled 3.8ppl.

We know that input prices continued to increase through the rest of 2021 and into 2022, particularly for fertilisers. While we don’t yet know the impact of this on actual farm costs[3] we expect another move up in farm costs, further eroding the net impact of higher milk prices.

[1] Estimated costs for the middle 50% of AYR calving herds.

[2] Based on Defra agricultural input cost index values for Nov21 (latest available data0

[3] December agricultural cost indexes will be available in late February, after which the estimated costs of production will be updated for the 12 months to Dec-21.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.