Harvest progress, ex-farm sales and currency risk: Grain Market Daily

Friday, 16 August 2019

Market commentary

- UK feed wheat futures (Nov-19) fell further yesterday, closing at a contract low of £137.50/t, and have continued to fall further this morning.

- Having now fallen through the psychological support of £140.00/t, UK feed wheat futures are being driven by a strengthening pound and the prospects for a large domestic wheat crop.

- The value of the pound looks set to break the previous 14 weeks of loss against the euro. Having risen by 2% in the last 5 days, from £1=€1.074 to £1=€1.096 by 10:30 today.

Harvest progress, ex-farm sales and currency risk

Although the wheat harvest has been delayed by rain, by 13 August approximately 27% was complete. In the East of England, farmers have been reporting strong yields averaging 9.9t/ha, with a good proportion yielding over 10t/ha. The latest ADAS harvest report is available here.

With good harvest yields, the prospects are for a larger wheat crop with talk of production above 15.5Mt. Yet with 27% of the wheat harvest complete, sales have until recently been lacking.

Corn Returns ex-farm volumes

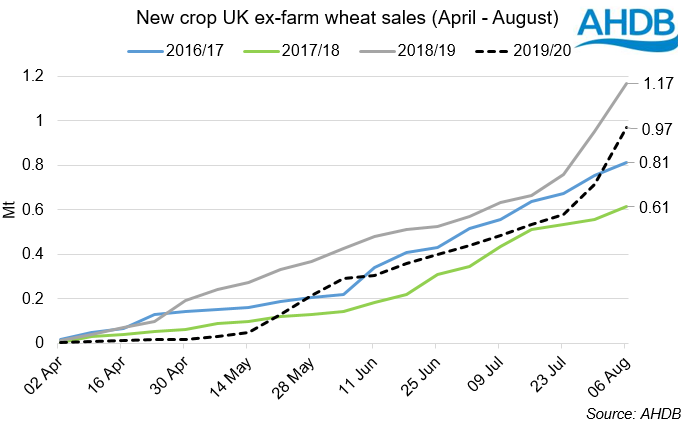

Cumulative ex-farm sales of wheat for the 2019/20 season from April to 8 August have been below that of 2018/19, and remain only 157Kt above that of 2016/17. Corn Returns volumes show 0.97Mt of the wheat crop sold from April to 8 August. This leaves a large proportion yet to be priced and at risk of Brexit disruption and global volatility.

As the potential size of the crop has grown, and Brexit looming, the UK wheat price has been increasingly pushed lower. The recent spike in ex-farm wheat sales has further pressured UK wheat markets as supply is being faced with limited ‘hand to mouth’ demand.

With a dry forecast for next week, harvest progress and realisation of expected high yields, may bring added pressure to spot markets. If as-available ex-farm sales remain strong, domestic haulage logistics are likely to be pressured.

Currency Risk

With a larger crop expected, the necessity to export feed wheat has grown with the time period for the UK to export to the EU getting shorter by the day.

In order to gain export sales to the EU, the UK has had to move to a discount to other origins. The extent to which UK feed wheat is discounting to Black Sea and EU origins has grown, in order to overcome any potential risks and gain attractiveness.

Yet while a hard Brexit remains a large risk to UK agriculture, a deal scenario could bring its own potential currency risks.

In the event of a deal, the pound could likely reverse some of the weakness brexit uncertainty has caused. Should the pound strengthen back to levels seen earlier in the year of £1=€1.17, then Nov-19 futures may need to fall below £130/t to stay export competitive.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.