Wheat markets shifting on crop prospects: Grain market daily

Friday, 17 May 2024

Market commentary

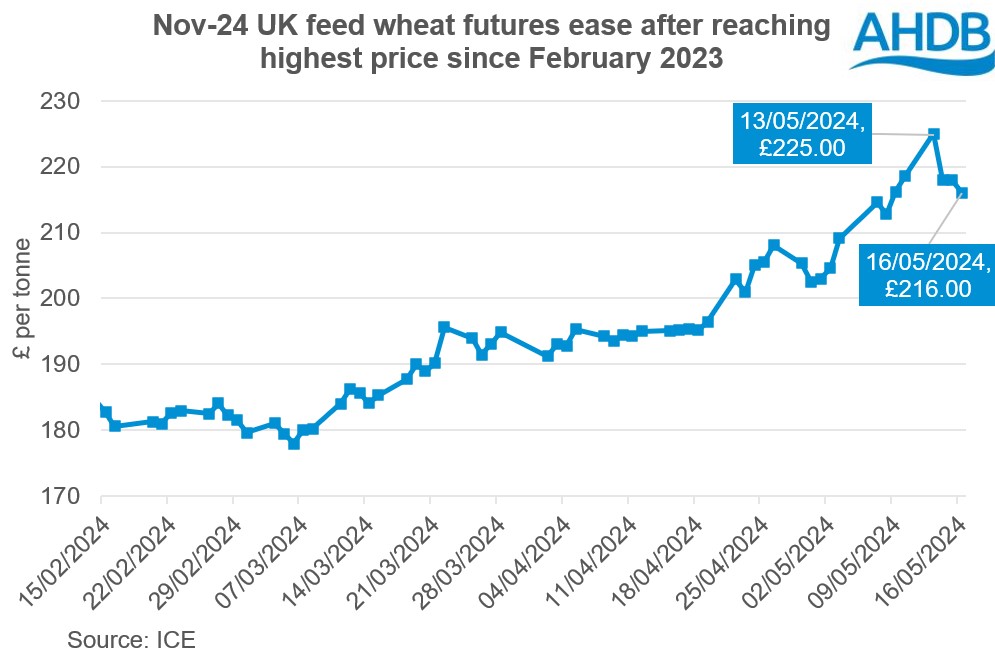

- UK feed wheat futures declined again yesterday in line with the global trend. The Nov-24 contract lost £1.95/t to settle at £216.00/t the lowest price since 8 May

- Wheat markets have eased back in the past few days on forecasts of rain in the south of Russia and improved prospects elsewhere (see below). Selling by speculative traders after prices rose sharply on Monday and technical signals showing markets may have been oversold also contributed

- Nov-24 Paris rapeseed futures also dipped, losing €1.75/t to €481.75/t (approx. £413/t)

- New-crop Chicago soya bean futures ended slightly down with ongoing worries about Brazilian soyabean crops, balanced by lower demand in the US. Stronger soy oil and crude oil futures also contrasted with a dip in Malaysian palm oil futures

Wheat markets shifting on crop prospects

Markets have fluctuated this week, largely due to new information on crop prospects and changing weather forecasts.

The main concerns still centre on the Russian wheat crop. Insights into damage from frosts on Monday pushed Nov-24 UK feed wheat futures to its highest level since February 2023, though the potential for rain in southern areas has contributed to prices easing back mid-week. Elsewhere, there have been reports of steady or positive factors for crops too.

In particular, a crop tour in the largest wheat growing state in the USA showed positive results. While there was a lot of variation across the state, the Kansas Wheat Commission tour projects the wheat yield in the state at 3.13 t/ha this is the highest since 2021 and above the five-year average (2.85 t/ha). As a result, the tour pegged production in the state above last week’s first forecast from the USDA.

Meanwhile, Stratégie Grains increased its estimate of EU-27 wheat production by 1.7 Mt to 123.5 Mt (Reuters) this is still 2.6 Mt below last year’s crop. The increases reflect that crops remain in overall good condition in Spain with harvest now rapidly approaching, along with improvements for Romania and Bulgaria. The forecaster also increased its estimate of barley output by 0.5 Mt to 53.0 Mt, some 5.6 Mt above last year’s poor crop.

Earlier in the week, the French Ministry of Agriculture left its estimates for 2024 winter wheat, winter barley and winter rapeseed areas unchanged from last month but at sharply lower levels than last year. The French maize area is forecast to rise 10% from 2023 but still below average; maize planting is ongoing.

FranceAgriMer reported this morning that French crop conditions (winter wheat, winter barley and spring barley) were stable in the week ending 13 May. Winter crops remain in the worst conditions for four years, but the spring barley rating is now above 2022 levels. These crops are now flowering, so weather conditions are crucial to yield potential.

Also today, the German government confirmed an 8% drop in German wheat area to 2.6 Mha following the wet autumn. The winter rapeseed area is also down 6%, while there’s a 13% rise in spring barley area to 363 Kha. The falls in wheat and rapeseed areas are steeper than those (6% and 5% respectively) estimated by the German association of farm co-ops last month.

So far today, prices are trading higher again. This is due to concerns about Russian wheat crops and access to Black Sea supplies following the latest news on the conflict in Ukraine. At midday (17 May), the Nov-24 UK feed wheat futures contract was up around £1.00/t to £217.00/t.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.