Grain markets waiting for direction: Grain market daily

Friday, 12 March 2021

Market commentary

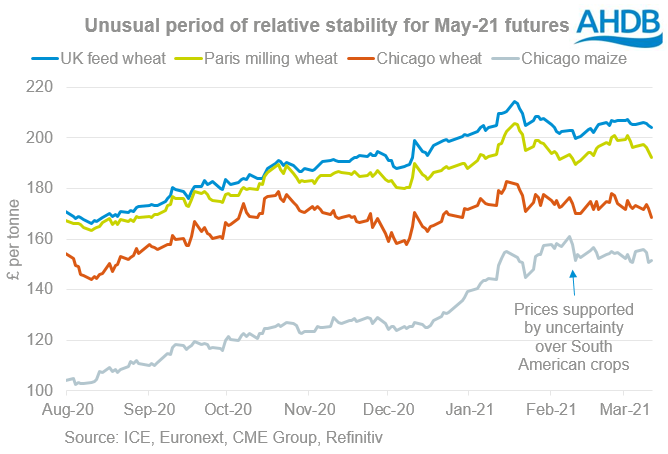

- UK feed wheat futures (May-21) closed at £204.25/t yesterday, down £0.75/t. This is a far smaller fall than US and Paris wheat futures. It’s likely linked to a rise in Chicago maize futures because of uncertainty about South American production.

- Paris wheat futures fell yesterday after Egypt bought Romanian, rather than French, wheat in its first tender for over a month. US prices closed lower as forecast rain could support winter wheat crops as they emerge from dormancy.

- New crop (Nov-21) Paris rapeseed futures set another new contract high yesterday, rising €8.25/t to close at €446.50/t. This equates to approximately £382/t (Refintiv). Tight old crop supplies globally and expectations for only a slightly bigger European crop in 2021 are supporting prices.

- If you missed our Spring Grain Market Outlook webinar on Tuesday, you can catch up by listening to the podcast. We talk about the key drivers for global and domestic markets, the path for fuel, fertiliser and interest rates, and the future of farm policy.

Grain markets waiting for direction

Global grain prices have been relatively stable since mid-January. Markets are waiting for more insight into the South American maize crops. Old crop prices are shown below but new crop prices are following a similar pattern, albeit at a lower level. Despite several estimates being released this week, we’re no closer yet to knowing the size of these crops.

This season, the stocks of wheat and maize in major exporting countries are expected to fall to their lowest levels for several years. These forecasts include relatively large maize crops from South America. If the South American crops are smaller than these forecasts, stocks of both wheat and maize could be even smaller.

What’s the latest?

Yesterday, the Brazilian government agency Conab increased its forecast for the total maize production by 2.6Mt. This is because Brazilian farmers intend to respond to high global prices and plant a larger area to Safrinha maize. The Safrinha or second crop is planted after the soyabean harvest.

At 108.1Mt, the latest Conab estimate is 5.5Mt above last year’s crop. It is also only 0.9Mt behind the latest USDA forecast, released on Wednesday.

But, the Safrinha crops are being planted late because the soyabean harvest is late. So there is a higher risk of dry weather when the Safrinha crops reach their key yield forming growth stages. Crops were also planted very late in 2015 and 2011. In 2015 rainfall during April and May was good and Safrinha yields were high. But, in 2011 lower April rainfall cut yields and crop sizes.

Meanwhile, there are mixed views on the impact of renewed dry weather on maize crops in Argentina.

On Wednesday, the Rosario Grain Exchange kept its forecast at 48.5Mt, 1.0Mt above the latest USDA forecast. Rosario said soil moisture in the west of the country is supporting later sown crops, which are still at critical growth stages. In contrast, the Buenos Aries Grain Exchange (BAGE) cut 1.0Mt from its forecast yesterday, to 45.0Mt due to the dry weather.

Where next?

At higher prices, this sort of stability doesn’t usually last long; it’s more common at lower prices. This unusual stability could last a little longer but I think it’s unlikely to last too long. This is because more and more information will be released as we move through the spring.

Although the Brazilian crops won’t be harvested until the middle of 2021, the results of the Argentinian harvest will soon start to emerge. We’ll also start to focus on Northern Hemisphere planting. The USDA releases the results of its survey of US farmers’ planting intentions on 31 March. The USDA also starts reporting crop progress and conditions weekly from 5 April.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.