US maize uncertainty to be eased by ethanol: Grain Market Daily

Friday, 19 July 2019

Market Commentary

- UK feed wheat futures continued their recent decline yesterday.

- Earlier this week the 20-day average dropped below the 50-day average.

- The trend has continued over the course of the week and at yesterday’s close the 20-day average was sitting just £0.66/t above the 100-day average.

- With improved weather in the US and the French harvest progressing well (33% complete – week ending 15 July 2019) wheat markets are lacking support, and could continue to drift lower.

US maize uncertainty to be eased by ethanol

- Recent upward pressure in maize markets has been felt across global grain markets.

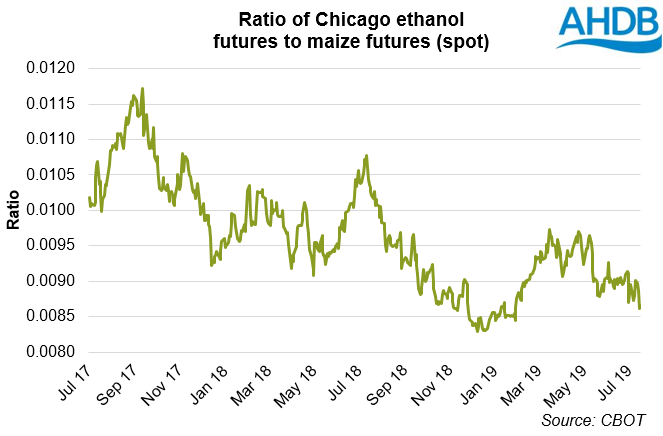

- Ethanol producer margins have been squeezed with the ratio of ethanol futures to maize futures falling.

- If ethanol production were to ease in the US, pressure in US maize markets may ease.

Recent upward pressure in maize markets has been felt across global grain markets. In previous Grain Market Daily’s we have highlighted the uncertainty surrounding the crop. Going forward challenging ethanol margins in the US could ease pressure on US maize and global grain prices.

US ethanol prices had risen in recent months, reacting to the rise in the value of maize, and the Trump administrations increase in biofuel policy. However, the price increases in maize futures have been more extreme than changes in ethanol prices, squeezing producer margins.

The ratio of ethanol price to corn price has fallen 6.5% since the beginning of May. Even so production of ethanol in the US Midwest last week was up year-on-year and the highest for July since 2010. However, with producers likely running on already committed stocks there will be question marks over whether ethanol production in the US will continue to the same degree with weaker margins for producers.

An article published by Reuters further highlights the challenge, with the share price of two key ethanol producers falling to new lows recently.

If ethanol production were to ease in the US, pressure in US maize markets may ease. This has the potential to reduce support for maize prices. That said, the USDA currently estimate US maize production at 352Mt, 18.5Mt more than the IGC forecast.

UK focus

On Tuesday 16 July the All Party Parliamentary Group for British Bioethanol released the findings of its report on the introduction of E10 policy in the UK. While the report recommends the swift implementation of E10, it is worth noting that it expresses the views of the group rather than of parliament. As such UK wheat demand for UK produced bioethanol remains uncertain.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.