Analyst Insight: Large UK oat area challenging for prices

Friday, 12 July 2019

Market Commentary

Yesterdays USDA WASDE report reduced 2019/20 global wheat production by 9.4Mt. Major exporters Russia (-3.8Mt), the EU (-2.5Mt) and Ukraine (-1.0Mt) primarily drove these reductions. However, forecasts are still above last year.

Corn production estimates were revised up based on the Acreage Report released 28 June. However, Acreage Report results are currently under revision, so uncertainty remains around the corn supply.

Chicago soyabeans (Nov-19) and Paris rapeseed (Nov-19) have gained $8.36/t and €6.25/t respectively since Friday. Yesterday’s WASDE showed reduced oilseed supply predictions for 2019/20, with poor global growing conditions muting yield expectations for most major oilseed producing countries.

Large UK oat area challenging for prices

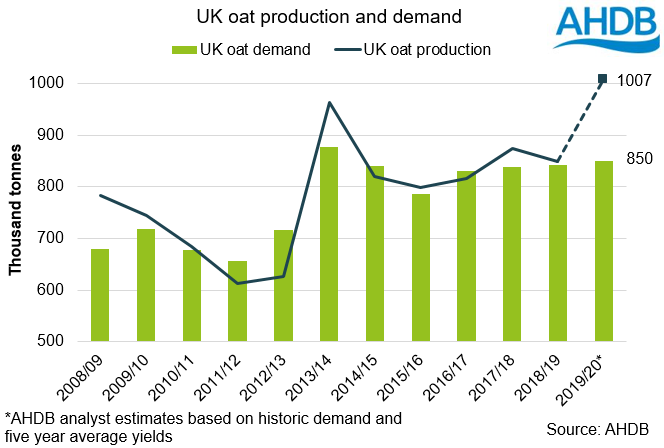

UK oat production looks set to be the highest since 1973. Oats inclusions in the rotation have increased in recent years to control the threat of grassweeds. But increased oat acreage in the UK is a challenge for the domestic market. UK demand for oats is finite. If the UK harvests around 1Mt of oats this year then UK oats will need to find an export market in the face of challenging tariffs.

The English and Scottish oat area for harvest 2019/20 is estimated at 178Kha, up 8% on the year (AHDB Planting and Variety Survey). If we achieve a five year average yield then oat production will top 1Mt for the first time since 1973.

While UK production is expected to be bumper, demand for the crop is finite. Assuming domestic oat demand of 850Kt. If production is 1Mt taking stocks into account, the UK has a need to export around 180Kt.

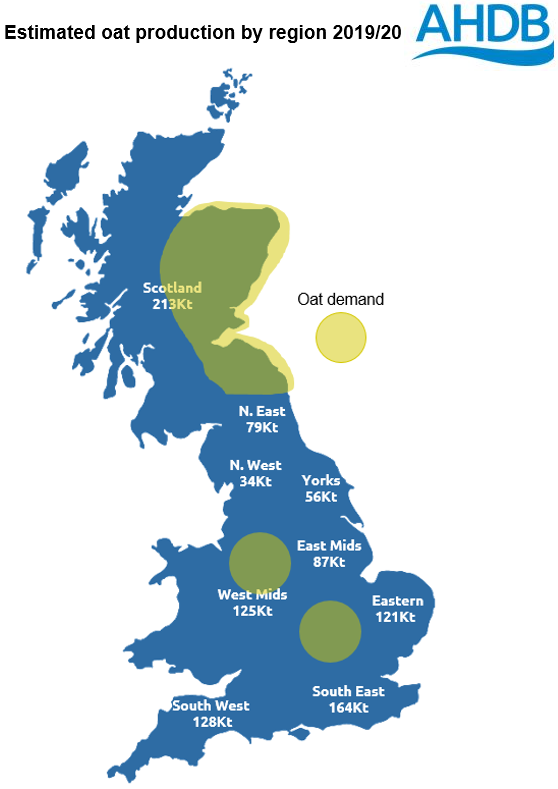

Large increases have been seen in the South East and East Midlands, oat demand in these regions is very limited. As such exports out of the south coast will be crucial next season.

On average (2014-2018) 93% of UK oat exports are destined for the EU. Beyond the 31 October, oats could face a tariff of €89/t. In the event of a no deal this tariff is all but prohibitive of oat trade with the EU.

The remaining trade has largely been with China, North Africa, North America and Norway, markets that will become increasingly important to the UK oat market in the event of no deal.

The ability of the UK to access these markets will be dependent on;

- Quality of oats.

- Ability to access alternative markets.

- Competition for export trade.

Assuming that the UK has most favoured nation status once leaving the EU, there will be no significant disadvantage for exports to Norway, North America and China, relative to trading whilst in the EU.

For trade with some North African nations there are tariffs which could affect UK trade once we leave the EU. However, the impact of these tariffs is likely to be small.

The major challenge for UK exports in a post-Brexit environment will be competition from Scandinavian producers. Despite late drilling for some oat crops in Scandinavia and recent dryness, conditions are currently positive with good oat crop expectations.

The challenge for oats last year was quality. The drought conditions resulted in high screenings and firm milling oat prices. If this happens again we could see oat prices stay relatively firm.

Furthermore, the milling oat market is largely contracted with prices based on wheat futures. As a result milling oat prices will be dependent on movements in wheat markets as much as domestic market fundamentals.

But, the UK is likely to have a large exportable surplus of oats, with huge tariffs to export into the EU and significant export competition. As a result, the domestic oat price will likely come under pressure next season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.