Is oilseed rape on a bull run? Grain Market Daily

Thursday, 18 July 2019

Market Commentary

European grain markets have dropped back down again this morning, after closing yesterday slightly higher. UK feed wheat (Nov-19) closed yesterday £1.25/t higher at £148.00/t. Paris milling wheat (Dec-19) closed yesterday €1.00/t higher at €181.25/t.

US grain markets continued to drop yesterday and has remained in decline this morning. Chicago wheat (Dec-19) closed at $190.06/t and Chicago corn closed at $173.81/t. The drop in US grain markets comes following some more favourable weather breaking the hot and dry spell. Further beneficial weather forecast for the coming week also alleviated concerns around crop progress.

Is oilseed rape on a bull run?

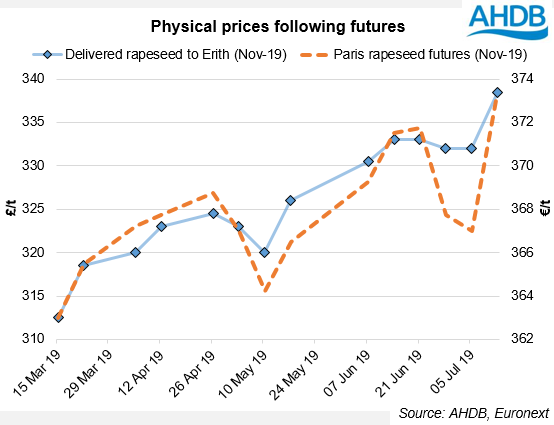

- New-crop Paris rapeseed futures (Nov-19) have been on an upward trend since early March

- UK physical prices have followed suit with a gain of £26.00/t from 15 March to 12 July

- Continually weakening sterling also adds support to UK physical prices

With peaks and troughs, Paris rapeseed futures (Nov-19) have generally been on an upward trend since early March. From 04 March a gain of €15.00/t has been achieved to close yesterday at €375.25/t, the highest since October 2018.

Although Paris rapeseed futures have been following Chicago soyabeans closely, Tuesday saw them head in opposite directions. US soyabeans lost value based on better prospects for US soyabean production, as welcomed rain struck early this week and cooler weather is forecast for the coming week. Paris rapeseed, on the other hand gained, as European prospects continue to lessen along with Ukraine, a key import origin for the EU.

UK production is still difficult to predict with a mixed review on yield prospects for 2019 harvest. We know there is a further reduction in 2019 area post-winter. However, there have been some reports that as harvest is approaching farmers are choosing not to combine. Some farmers are writing crops off at this stage and therefore the harvest area is difficult to predict. Other UK farmers are optimistic about OSR yields and have had little issues through the season.

With the uncertainty around yields and quality as harvest approaches, the physical UK prices have been following the same upward trend as futures. OSR delivered into Erith in November has gained £26.00/t from 15 March to 12 July, quoted £338.50/t. The difficult UK season this year has kept prices relatively high. Last year OSR delivered into Erith in November was priced at £323.00/t on 13 July 2018.

The physical prices also have support from a continually weakening sterling. On Tuesday, the pound dropped to the lowest value against the Euro this year. Although it has marginally strengthened since then, it closed yesterday at £1=€1.1075 likely continuing to support physical prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.