Global Long term currency prospects: Grain Market Daily

Wednesday, 5 February 2020

Market Commentary

- UK feed wheat futures recovered slightly from the near 6-week low on Monday, May-20 closed yesterday at £152.50/t, up £0.75/t and Nov-20 £160.70, up £0.95/t.

- Driving the slight recovery, has been a firming in Paris and Chicago based futures as export pace remains supportive. However, following the global downturn in commodity markets due to coronavirus fears, commodity markets are likely to remain under a degree of pressure.

Long term currency prospects

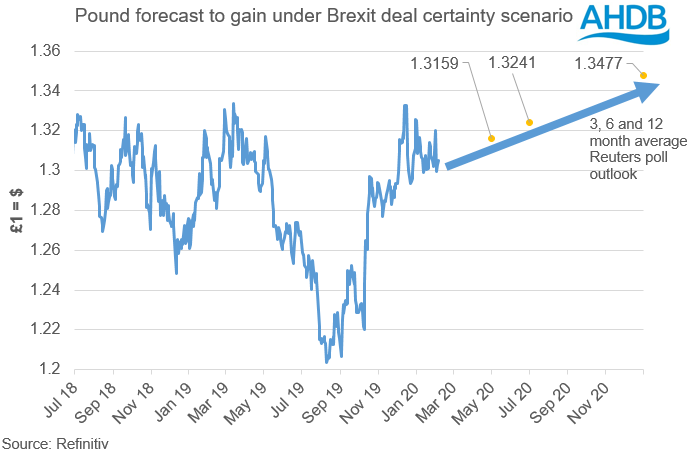

The last couple of years have seen a large degree of volatility in currency, with the value of the pound generally under pressure due to Brexit uncertainty. This pressure has provided additional support to domestic agricultural products.

Yet since August, the value of the pound relative to the dollar has gained over 9%, dampening the degree of support that the domestic market has received from global grain market gains.

However, following the general election and passing of the withdrawal agreement, there has continued to be a large degree of volatility, the value of the pound relative to the euro swinging between £1=$1.29 to £1=$1.33 during December and January.

As negotiations with the EU about our future trading relationship continue and provide certainty, the value of the pound may well receive increased support.

This sentiment is echoed by a recent Reuters’ poll for the outlook of the pound. If a trade deal with the EU is reached, the pound has been forecast to gain a further 4% relative to the dollar by the end of the year. Yet with little certainty so far, there are some forecasting a fall in the value of the pound under a less favourable Brexit scenario.

Domestically, new crop wheat futures have been trading at an import parity level relative to European origins, and old crop markets have also received support from the prospects for a deficit next year. With the domestic market for next season already at import parity, further new crop gains are likely to be mainly impacted by just two factors, global outlooks and currency.

While it is a little early to have a comprehensive outlook for global grain supply in 2020/21, what is expected is continued export dominance by Black Sea nations. This will continue to keep European markets under a degree of pressure. If this is combined with a possibility of further gains in the value of the pound, 2020/21 UK feed wheat futures could well come under pressure.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.