Australian wheat woes: Grain Market Daily

Tuesday, 10 September 2019

Market Commentary

Global wheat markets pushed slightly higher over the course of the last week as dryness in the Southern Hemisphere becomes influential. Meanwhile continued beneficial US weather for the late-planted maize crop is balancing with downgraded crop condition scores.

Additionally, with the latest USDA WASDE out on Thursday, short positions may have been squared in anticipation. This likely provided a degree of support for grain futures.

The first provisional results of the AHDB Cereal Quality Survey are now available. Wheat quality from the earlier harvested regions is largely in line with last year. However, quality in later crops may have been affected by more changeable weather conditions prior to harvest.

Australian wheat woes

With the majority of the wheat harvest in the Northern Hemisphere nearing completion, and the maize crop not far behind, the global focus will soon shift once more to conditions in the Southern Hemisphere.

Although there has been a mixed growing season in the Northern Hemisphere, there is a common theme developing south of the equator - it is dry.

Australia

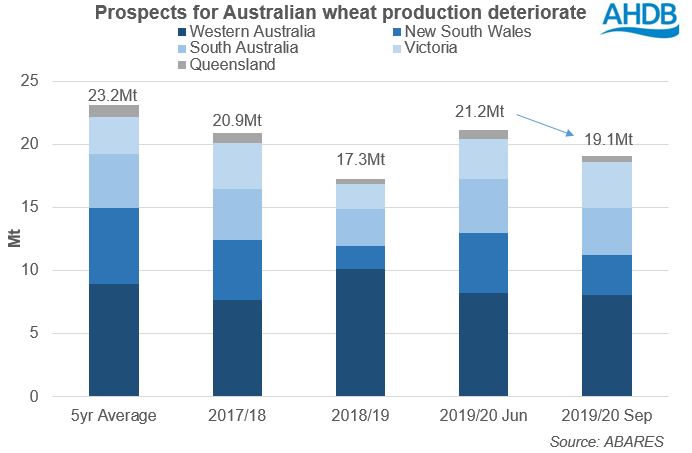

Another year of drought like conditions in Australia have led to downgraded wheat production forecasts. Wheat production has been downgraded by 10% from June, to 19.1Mt in the latest September ABARES crop report.

Large areas of New South Wales are in extremely low or severe deficiency rainfall percentiles. Production forecasts for New South Wales have been downgraded by over 32% in the September crop report, with production estimates down 1.5Mt, to almost half that of the 5 year average (6Mt).

Additionally, the largest wheat-growing region of Western Australia has recorded below average rainfall in July and August, increasing the risk of heat stress as Australia moves into spring. A 16% decrease in yield predictions has resulted in production forecasts to be over 20% back on the year, at 8Mt.

Brazil

While weather conditions in Brazil are favourable for the planting of first maize and soyabean crops, a prolonged warm and dry period remains forecast. With below average soil moisture in key first maize planting states and little rainfall forecast, crop conditions will be watched carefully for the global supply of maize.

Outlook

Although there are signs that global grain production in 2019/20 might not be as abundant as previously forecast, the domestic market will likely remain under pressure for the foreseeable future. Why? The key levers are the UK remains well supplied with wheat, alongside the catch 22 Brexit risks of No-Deal tariffs or a currency rebound.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.