Price Support for Oilseed Rape? Grain Market Daily

Tuesday, 16 July 2019

Market Commentary

In a return to the trend of a falling grain market, Nov-19 feed wheat futures closed lower yesterday at £147.25/t and have continued to fall this morning trading at £146.75/t at midday.

Concerns about the adverse dry and hot conditions for US maize were somewhat alleviated in the latest weekly USDA Crop Progress report. The proportion of maize in good and excellent condition, at 58% is not only higher week on week but above market expectations, removing some of the support from global grain markets. Likewise the proportion of the soyabean crop in good and excellent condition was raised above market expectations.

Arable Analyst - Peter Collier

New support for oilseed rape?

Following an unfavourable growing season for oilseed rape both in the UK and across Europe, imports are going to be essential.

Nationally, the English area is down 11% and the Scottish area down 6% year on year. With reports from the #AHDBCropTour seeing highly variable yield expectations it would be hard to justify anything higher than average yields giving production circa 1.7Mt, and domestic consumption of around 2Mt. Additionally, Europe as a whole is forecast to require over 4.5Mt of imports.

The cyclical nature of EU import origins has Ukrainian oilseed rape imported from August until December and Australian imports for the second half of the season, with occasional Canadian imports.

Ukraine Prospects

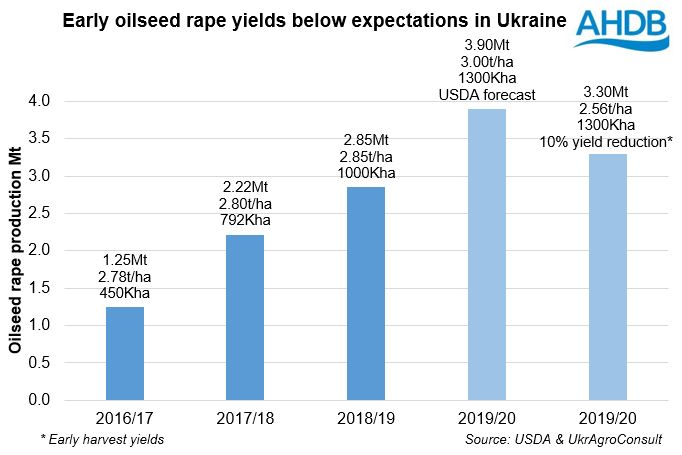

While the oilseed rape area across Europe has been in decline, Ukrainian OSR has reached a record area of 1.3Mha. Yields have also been increasing year on year and the USDA is forecasting 3t/ha for 2019 harvest.

The USDA forecast production at 3.9Mt, and until now this has been factored in as a major import origin for the EU oilseed rape market in 2019/20.

However, with 59% of the crop harvested, yields are down 10% from last year (UkrAgroConsult). Although yields have previously increased as harvest progresses, there would need to be a significant yield increase in later harvested crops to achieve forecast production.

Working with a 10% year on year yield hit, Ukrainian production could well be closer to 3.3Mt. Although still the largest on record, reduced production and 0.4Mt domestic consumption would equate to a possible 2.9Mt exportable surplus, 0.6Mt less than previously factored in.

With the outlook for available rapeseed close to Europe reduced, there is still a minimum of 2Mt requirement should the EU take the entirety of the Ukrainian surplus. This will place additional importance throughout the year on the development of the Australian crop.

#AHDBCropTour makes final stop

The #AHDBCropTour reached Yorkshire yesterday for the final stop of this year. AHDB Cereals and Oilseeds Chairman was our host at Wold Farm just outside of Driffield.

Paul discussed his move to no-till and the benefits that this has brought along with reducing insecticide applications. Reviewing Paul’s crops of Leeds being grown for seed, he felt that yields would be close to average in the range of 9.5-10t/ha. Some wheat crops were showing signs of drought stress with curling leaves, but forecast rain towards the end of this week would alleviate this.

James Maguire, National Seed Sales Manager at KWS Ltd joined the tour for this leg. James told us he expects a move from group 4 wheats into group 1-3 for the autumn sowing. “New additions to the group 1, 2 and 3 market, as well as existing varieties with excellent agronomic profiles, allow farmers to hedge their bets by diversifying their plantings whilst also offering a product for domestic markets”.

Moving onto oilseed rape and whilst Paul has not had the impact of Cabbage Stem Flea Beetle, the weather has given its own challenges. “After getting through flea beetle and pigeons, we had 30 hours of wind and rain in May which has flattened some crops”. Whilst the crop is still harvestable, it is another example of how variable yield will be for OSR this year.

Discussing the value of OSR in rotations James suggested “if you’re able to get oilseed rape planted and established in good weather, it remains a profitable break crop”. Whilst Paul suggested “Oilseed rape is a crop that is worth persevering with, being a winter sown crop, even if we struggle after establishment I have opportunities to re-sow in the spring… across the last 20 years, it’s been our best break crop”.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.