Good start to the 2021/22 marketing year for UK feed wheat: Grain market daily

Wednesday, 5 January 2022

Market commentary

- UK feed wheat futures (May-22) closed yesterday at £224.00/t, down £0.50/t from Friday’s close. In the same time, Sterling strengthened (+0.72%) against the Euro counteracting the small rise in Paris futures (May-22).

- Paris milling wheat futures (May-22) gained €0.75/t since Friday, but €4.75/t from Monday, to close yesterday at €277.50/t.

- Support to the European market came from Chicago maize and wheat futures (May-22) gaining $7.28/t and $4.41/t respectively from Monday’s close.

- Dryness concerns continue to aid bullish sentiment with South American weather potentially hampering maize (and soyabean) prospects. Also, dryness in the US is causing concern for new crop wheat as crop ratings slip in key producing states Oklahoma and Kansas.

Good start to the 2021/22 marketing year for UK feed wheat

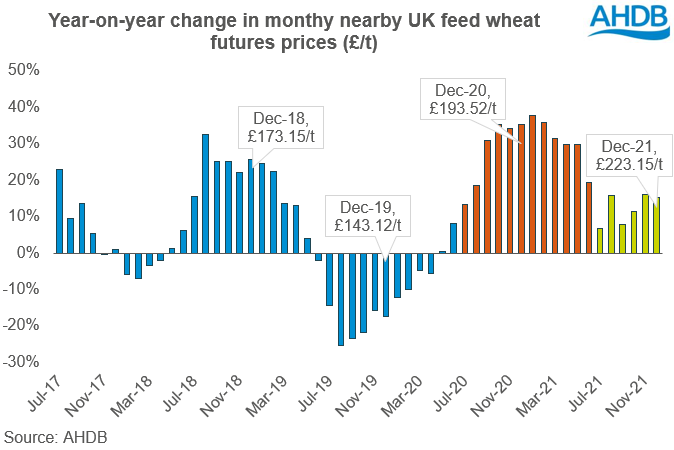

Nearby UK feed wheat futures prices are higher than the same time last year. This is on the back of tighter global stock-to-use. The average price for December 2021 was £223.15/t, 15% above December 2020 (£193.52/t) and 42% above the five-year average.

In the UK, the wheat supply and demand picture looks better than last year, with an increase in total availability for this marketing year (2021/22) from last. However, it remains tighter than previous years.

This year it is anticipated that the UK will have a surplus of wheat, unlike last year (2020/21) when there was a deficit. In the latest AHDB balance sheet (November 2021) the UK is estimated to have a wheat surplus of 557Kt. This is down 59% (816Kt) from the five-year average. UK wheat availability this year is down from averages due to significantly low opening stocks. At 1.42Mt the wheat opening stocks in July 2021 were the lowest since at least July 1999.

UK wheat prices are not only elevated on the back of domestic supply though. Global prices have also been historically high throughout the start of the 2021/22 marketing year, due to tighter supplies.

For this marketing year global demand is anticipated to be 9Mt higher than production. Currently, the stocks-to-use ratio for major wheat exporters is 12.7%, down from the five-year average of 17.5%.

With harvests nearly complete in the Southern hemisphere, the wheat supply picture for 2021/22 is nearly confirmed. We await final figures from Australia and Argentina. With this in mind, prices are likely to remain somewhat elevated both domestically and globally, although there are other factors that may still influence prices.

This could come from maize markets, and demand remains somewhat uncertain with covid-19 restrictions causing concerns. The wider grains complex is awaiting decent maize crops from South America where dryness remains a worry and a major watch point.

Also, new crop plantings and prospects will begin to play a more prominent role in old crop prices. So, although in comparison to last season prices may well remain elevated, they could see pressure (or support) from wider factors.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.