Global support for wheat supports domestic prices

Friday, 10 July 2020

Market commentary

- UK wheat futures (Nov-20) closed yesterday at £169.45/t, up £0.15/t on Wednesday’s close. This contract has so far gained £2.75/t across the week. Significant gains are not recorded in domestic markets as sterling strengthens against the euro and dollar across the week.

- Paris milling wheat futures (Dec-20) closed yesterday at €188.75/t, gaining €1.00/t on Wednesday’s close, this contract has gained €4.50/t so far across the week.

- Chicago wheat futures (Dec-20) closed yesterday at $194.74/t, up $3.03/t on Wednesday’s close, this contract has gained $11.12/t across the week as commodity funds turn to net buyers of wheat and maize futures contracts.

Global support for wheat supports domestic prices

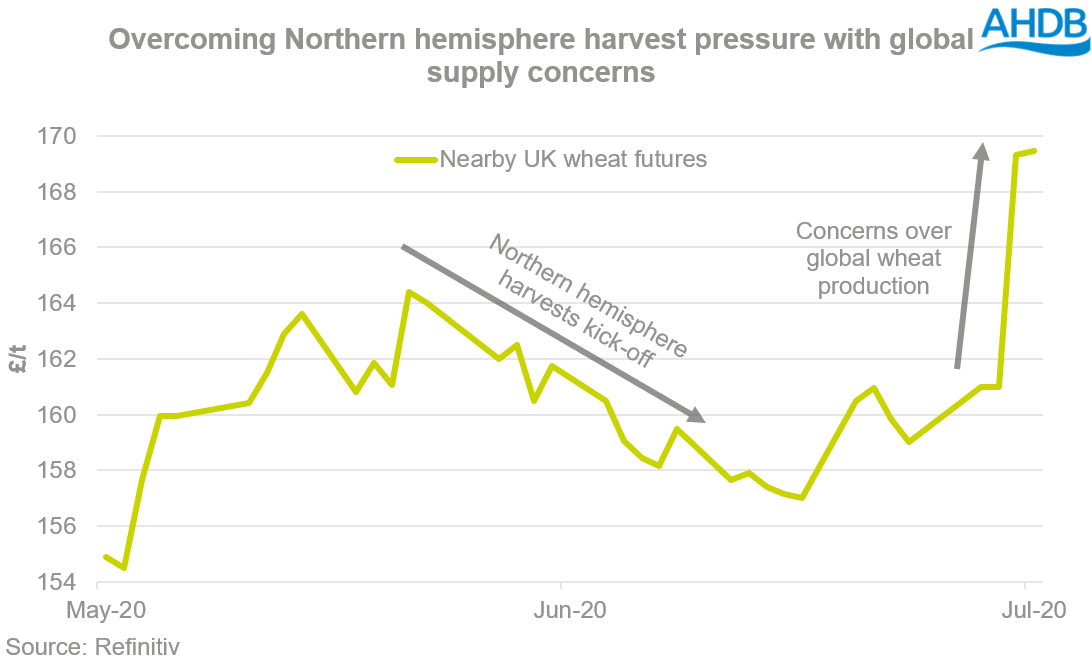

As northern hemisphere harvests were underway, global wheat markets were pressured as we commenced the 2020/21 marketing year. However, recently there has been worries over the global wheat supplies as many key producers revise the production down. The market awaits the latest WASDE report which will be released this evening (17:00).

Downward revisions for wheat production

In France it’s predicted that production will be down 20.8% year-on-year at 31.3Mt, according to FranceAgriMer. Furthermore, European exports are revised down 6.3% year-on-year to 7Mt.

Persistent dry weather along the Pampas grain belt in Argentina has meant the Rosario Grain Exchange lowered its 2020/21 harvest estimate to a range of 18-19Mt from 21-22Mt.

In the Black Sea region, ProAgro also cut its forecast for Ukraine 2020 wheat harvest to 26.07Mt from 26.65Mt. Also cutting their exports for 2020/21 to 17.8Mt down from 18Mt, due to poor weather. Moreover, wheat yields in Russia do not look promising as harvest commences, raising questions over their total production. On Monday agriculture consultancy SovEcon downgraded the Russian wheat forecast for 2020 down to 80.9Mt down from 82.7Mt.

How far will the price spike?

Domestic sentiment is bullish towards wheat as we head into a deficit. What is critical to note is this short-term global support to the market is momentary, and sentiment can quickly change.

November 20 wheat futures hit highs of £175/t in late March, and again in late May. As we near these highs again, there are still some risks to consider UK wheat prices.

Although there have been some revisions down to some key wheat producers which is supporting prices, we are still going into a global surplus. Sterling is weak which is insulating our domestic prices, but successful Brexit negotiations could offer support.

Despite the UK market being supported by the small crop, we can’t ignore maize. December 20 Chicago maize futures stand at a massive £58/t discount to November 20 UK wheat futures.

UK futures will remain at the top of global markets due to our small crop and import parity, but that doesn’t mean that prices can run away higher and higher unless we see further reductions to supply outlooks in major exporters.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.