Global pork export prices rose in the third quarter

Monday, 21 December 2020

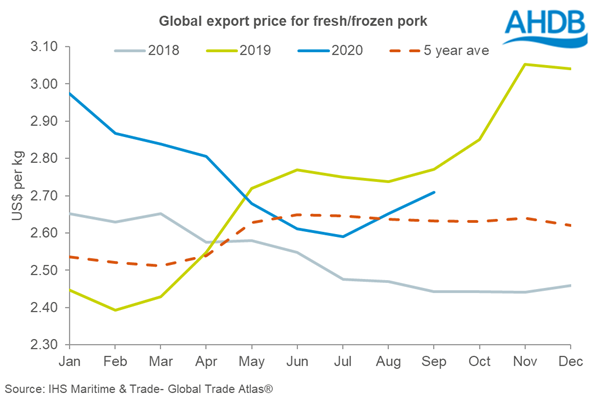

Global prices for internationally traded pork started to rise again in the third quarter, having declined during the first half of the year. This is based on average export prices from the major trading regions. From the low point in July at US$2.59/kg, the average global export price reached US$2.71/kg in September. This was the highest monthly price since April and meant prices were back above the 5-year average for the time of year. However, they remained below the highs recorded in 2019, though the difference narrowed somewhat.

The extent of the uplift in pork export prices during the third quarter of the year varied across the four main exporting regions (the US, Brazil, Canada and the EU). Prices were highest for EU exports, averaging $2.99/kg in September, a 3% increase compared to July. This is a different trend to that seen in EU farmgate prices, which declined by 10% across the same three-month period. There were a number of challenges affecting the availability of product for export during the quarter, which may have played a role in supporting prices at export level. Some plants were unable to export to China for a period due to COVID-19 outbreaks amongst staff, likely supporting prices for those that were able to maintain access. Germany also discovered ASF in its wild boar herd mid-September. Constrained processing capacity also led to pigs backing up on farm in some key producers, which would only be negative for prices at farmgate level. The increase in dollar terms is also exaggerated a little by some strengthening of the euro against the dollar.

The US export price showed less movement across the third quarter, reaching just $2.42/kg in September, less than 2% more than in July. The price competitiveness of US product compared to the EU was greater than in quarter two.

Brazilian pork exports were the cheapest amongst the four main exporters, at just $2.31/kg in September, though this was up from $2.12/kg in July.

Canadian prices also rose sharply during the quarter, reaching $2.55/kg in September, 6% more than the July average.

Overall, strong Chinese import demand against a backdrop of challenges in supplying the market from the main exporters enabled the boost to export prices. This may be a continuing theme in prices during the latter portion of 2020, when data becomes available. Nonetheless, price support from export markets won’t necessarily feed through to farmgate prices, if markets remained challenged by excess volumes that cannot be exported. This is a particular challenge for the EU market of course, as Germany remains unable to access the Chinese market.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.