Global milk production expected to tighten over winter

Wednesday, 20 October 2021

By Patty Clayton

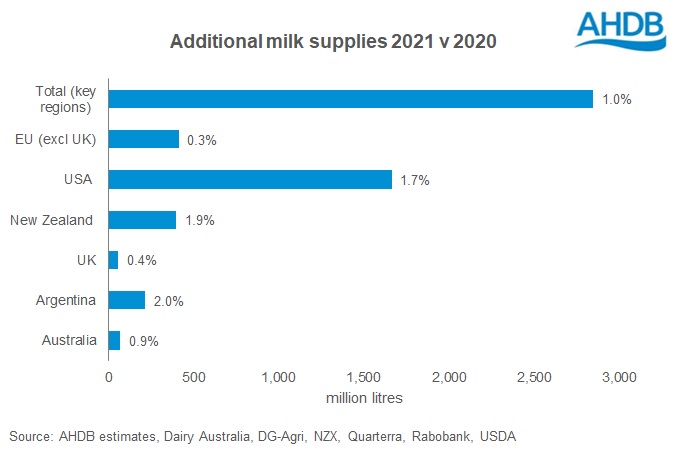

Challenging weather and high feed costs are expected to impact milk production through 2021, despite good prices. This has reduced global supply[1] growth forecasts for 2021 from 1.4% to 1.0%, equivalent to 1.1bn litres less milk.

Both the US and the EU-27 have cut their forecasts for 2021 production in their latest outlooks, reducing global estimates by around 1.4bn litres. However, this is partly offset by production growth in Argentina and New Zealand.

In the US, the lower forecast is due to a predicted drop in both cow numbers and milk yields in the second half of the year. This is expected to slow down the year-on-year production growth seen so far in 2021, as production cost increases strain farmer margins. However, annual production is still expected to see growth of around 1.7%.

A similar picture applies to the EU-27, with challenging weather over the summer and high feed costs impacting yields in some of the key producing regions. Here, there is some expectation that yields will recover through the final quarter of the year, although that is subject to affordability of purchased feed.

Meanwhile, volumes out of New Zealand for 2021 are forecast to be up 1.9% on last year, although this growth has already been delivered. Production growth over the remainder of this year will be difficult given the high volumes produced in 2020. Adding in the challenge of a potential La Nina event, and the resulting dry weather, there is the possibility of even lower volumes coming out of the region.

[1] Includes key exporting regions of EU-27, US, Argentina, Australia, New Zealand and the UK

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.