Global markets feeling the heat: Grain market daily

Thursday, 14 July 2022

Market commentary

- Markets saw some downwards pressure yesterday after there were reports that a Ukrainian export deal could be signed next week between Russia, Ukraine, Turkey and the UN.

- UK feed wheat futures (Nov-22) fell £1.40/t over yesterday’s session, closing at £275.30/t. The May-23 contract closed at £279.85/t, seeing a bigger loss of £2.45/t over the same period.

- UK trade data was updated yesterday. The UK imported 168,940 tonnes of wheat throughout May and exported 100,163 tonnes. Imports were up 38,763 tonnes from April’s figure and exports were up by 43,602.

- Paris rapeseed futures (Nov-22) lost €6.50/t yesterday to close at €672.25/t, also losing support because of the potential Ukrainian export deal.

Global markets feeling the heat

Global grain markets remain volatile as harvest pressure continues but concern over global supply is keeping prices historically high. Around the world we are seeing abnormally hot weather and minimal rainfall, adding further uncertainty to markets. The US, Europe and Argentina especially are feeling the effects of these extreme weather conditions and we could see global prices shift as a result.

US

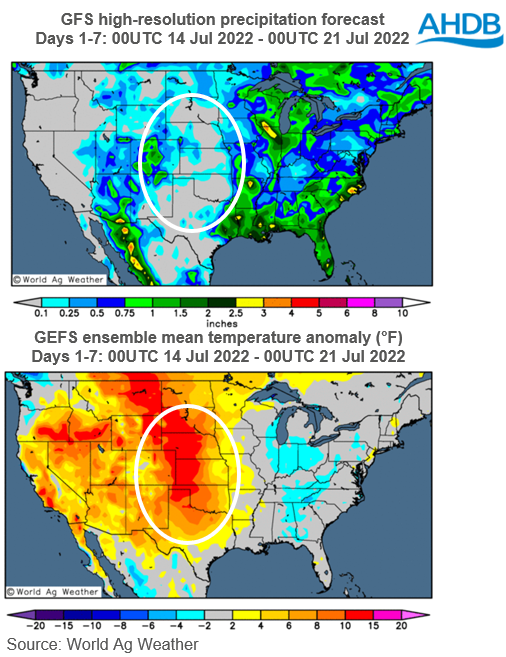

Chicago maize futures (Dec-22) gained $3.44/t across yesterday’s session, closing at $234.35/t. This price support came from concerns over yield losses as hot and dry weather is forecast in the US Midwest while the crop is beginning its crucial pollination phase.

The states outlined above (Oklahoma, Kansas, Nebraska and South Dakota) all have maize crops heading into silking phase, meaning that yields in the areas are currently particularly sensitive to moisture and temperature stresses.

In the July USDA World Agricultural Supply & Demand Estimate report, US maize production was revised up by 1.14Mt. However, this extreme weather could resurface concerns seen at planting time about the size of the crop and in turn tighten the global supply outlook going forward.

Europe

The dry and hot weather across Europe has accelerated harvest progression and farmers are being encouraged to start cutting before their crops start shedding seed or losing yield.

Stratégie Grains cut all EU grain crop estimates in their latest report released yesterday. Wheat and barley crop estimates had already been reduced in last month’s report due to overly dry conditions at the beginning of the growing season. Yields potentials are now being impacted further by the hot weather and water shortages that are expected to continue over the coming week.

EU barley harvest was expected at 49.6Mt, down 2.3Mt from 2021 and EU wheat harvest was seen at 123.3Mt, down 6.6Mt from 2021’s crop. If realised, both figures will add further supply concerns to an already tightened market and strong EU demand will likely keep prices supported.

Argentina

The expected 2022/23 wheat harvest in Argentina was revised down 800Kt to 17.7Mt on Wednesday. The decrease was mainly due to a drop in estimated planting area, now at 5.9Mha, down from the 6.2Mha forecasted in June.

Agricultural regions in Argentina have suffered from a lack of rain since the planting season began in May and as the crop is in its vegetative state growers will be hoping for a change in weather. However, looking to the next seven days there is little precipitation forecast, with only 0.1-1 inches expected in eastern parts of Santa Fe & Buenos Aires. In the latest WASDE, world wheat exports for 2022/23 are forecast to be 205.47Mt, with Argentina accounting for 13.5Mt. As a major exporter of wheat, lower production would mean tightened supply and further support to global prices.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.