Global grain rally resumes: Grain market daily

Wednesday, 27 January 2021

Market commentary

- UK feed wheat futures closed higher yesterday, at £208.50/t, up £1.65/t on Monday’s close. The jump in values followed renewed purchases of maize from China (read more below), and the adoption of the €50/t tax on Russian wheat exports from 1 March.

- Rains in Brazil have slowed the soyabean harvest, as a result May-21 soyabean futures made a third day of gains. Rapeseed values tracked this move higher, with May-21 Paris rapeseed futures closing yesterday at €432.00/t.

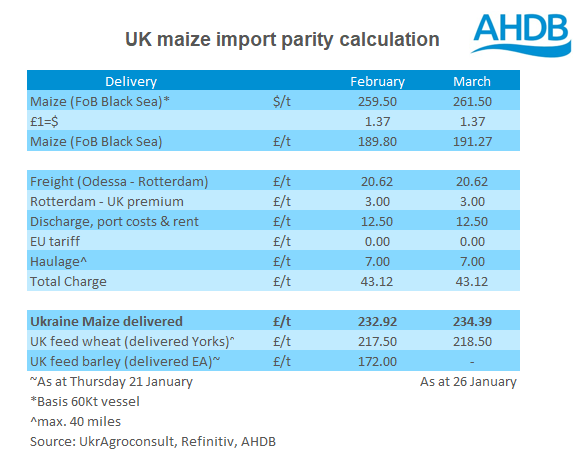

- The latest calculation for imported maize, places Ukrainian maize at £232.92/t for January delivery. This is down £4.73/t on the week. Owing to cheaper Ukrainian FoB values, and stronger sterling.

Global grain rally resumes

After a breather last week, and early this week, global grain markets have made further gains. In early trade today, Chicago maize prices (May-21) moved back up to a near contract high. The latest move has been sparked by fresh purchases as China were seen to buy 1.36Mt in the latest USDA flash sales report.

In a report released last week the USDA Foreign Agricultural Service maintained its estimate for imports of maize by China at 22.0Mt, this is 4.5Mt higher than the USDA official forecast.

With the maize market really tight at present, large demand and tighter supplies have a greater effect on prices than in a better supplied year.

The picture for maize this year is still far from set. With the second crop from Brazil still to go in the ground! As we have said before, weather in South America will be key to the future path of global and UK grain prices in the coming months.

Over the next few weeks, increased rain is seen in South America. But, beyond that rains are seen at more “normal” levels. One potential risk from rain now is a delay to maize planting in Brazil, so, while rain is needed to recoup soil moisture levels, it could also support prices.

High prices won’t last forever

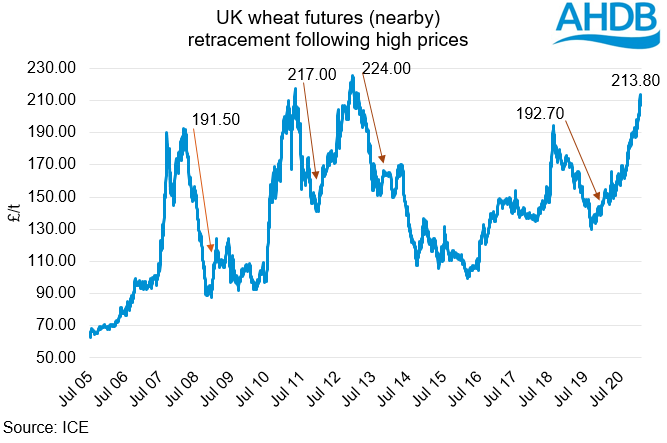

It is important to highlight that high prices don’t last forever, they either drive increased supply or destroy demand. In previous years of tight supply and demand, we have seen prices retrace in a big way.

The last time prices were sustained above £200/t (2012/13) nearby prices in the following harvest had fallen to £150-160/t.

With this in mind it is important to consider the value of forward markets. The Nov-21 contract closed yesterday at £166.25/t, almost £23/t ahead of the average of the previous 5 November contracts at this point in the season.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.