Global dairy prices drop back in 2020

Thursday, 6 May 2021

By Charlie Reeve

The latest Dairy Market Review, released by the UN Food and Agriculture Organisation (FAO), gives an overview of global dairy market developments in 2020.

Global Price Index

The global Dairy Price index dropped back slightly during 2020, to average slightly below 2019 levels. The dairy price index averaged 101.8 points in 2020, a drop of 1.0 points year on year. The report suggests the drop in global prices was due to decreased demand for imports caused by economic uncertainty. Other factors holding down global prices included increased availability of dairy products and, in some cases, reduced internal sales.

- Butter prices declined by 13.5% year on year

- Whole milk powder (WMP) prices declined by 4.5% yoy

- Skim milk powder (SMP) prices increased by 6.8% yoy

- Cheese prices increased by 2.1% yoy

Global milk production

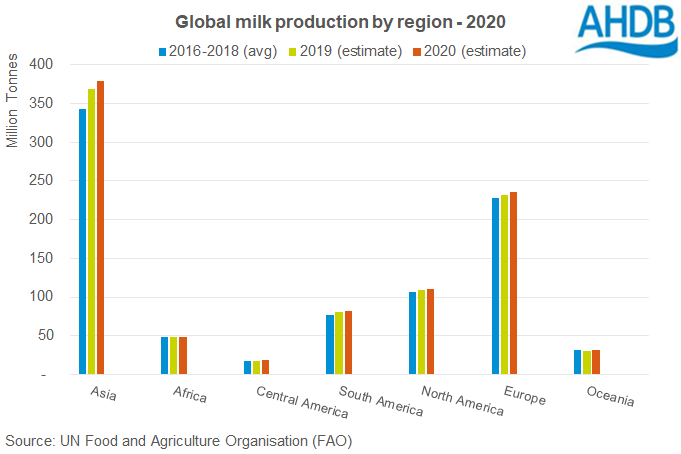

According to the FAO, global milk production rose by 2% in 2020 to total nearly 880 billion litres. Milk production was reported to have increased in all major regions with the exception of Africa, which remained stable at 48 billion litres.

Asia had the largest increase in production during 2020, with total output rising to 368 billion litres, a 2.6% increase on the previous year. The key exporting regions of Europe, North America and South America also had increases in production year on year. Government support through the pandemic helped stabilise farmgate milk prices, supporting increased milk production.

Trade

Global dairy trade increased by 1.2% in 2020 according to the FAO report. International trade totalled 79M tonnes (milk equivalent), an increase of nearly 1M tonnes year on year.

In 2020, China remained the largest importer of dairy products purchasing 17M tonnes of dairy products, an increase in volume of 7.4% on the previous year. Per capita dairy consumption in China is reported to have increased amongst some demographics. Increased demand for whey powder has also boosted Chinese imports, as China worked to rebuild its national pig herd.

The EU increased volumes of exports during 2020, alongside the USA and Argentina. However, both Australia and New Zealand export volumes declined year on year.

Looking at international trade by product; cheese, whey and whole milk power (WMP) had increased in volumes, whilst volumes traded of both butter and skimmed milk powder (SMP) declined year on year.

During 2020, Cheese export volumes increased by 4.1% to total 2.79M tonnes. This increase globally was due to notable increases in cheese exports from the EU (inc UK) and Belarus, which was reportedly supported by demand from emerging markets around the world.

Whole milk power (WMP) export volumes grew by 1.9% year on year, totalling 2.67M tonnes. Strong demand from North Africa and the Middle East help to support trade. Increased export volumes from the EU and Argentina fulfilled this increased demand.

Traded volumes of Butter declined by 6% to total 936,000 tonnes. This was reportedly due to increased domestic production in some importing countries and economic declines.

Skim milk powder (SMP) exports dropped back by 2.3% year on year to total 2.5M tonnes. The decline in trade during 2020 was reported to be due to economic factors and increasing domestic production in some of the traditional major importing countries.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.