German pork import demand subdued in early stages of coronavirus

Thursday, 28 May 2020

By Bethan Wilkins

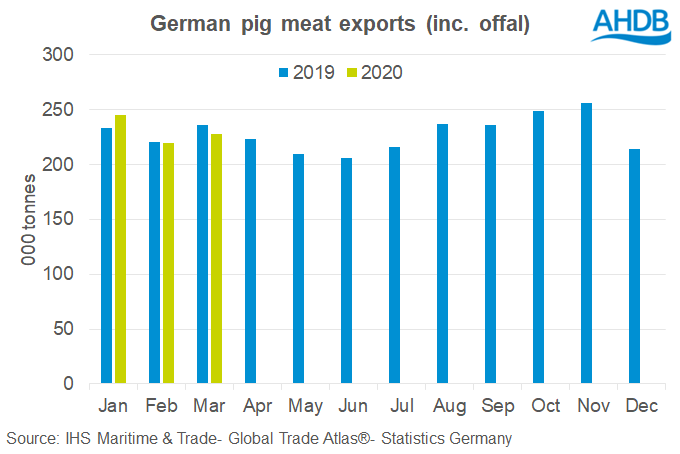

Clean pig slaughter in Germany was 3% below a year earlier in the first quarter of 2020. Despite this, exports were little changed, meaning domestic supplies remaining in Germany fell. Nonetheless, demand for imports remained subdued.

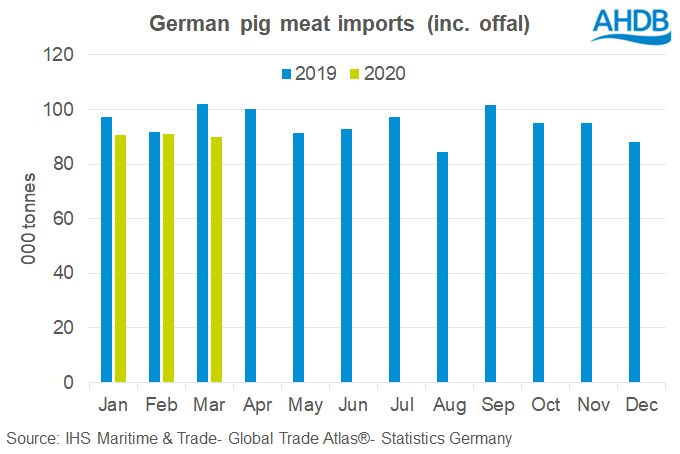

Total pig meat imports were 7% lower than a year earlier in the first quarter (-20,000 tonnes). The drop was particularly apparent in March (-12% or -12,000 tonnes). There are a range of reasons why escalating lockdown measures in Europe at this time could have accentuated the decline. Belgium and Denmark, the two largest suppliers of pig meat to Germany, both entered “lockdown” from the middle of March. This may have caused some disruption to supplies. German restaurants were closed from March 22, which cut demand from this sector. Social distancing measures may have also limited Germany’s ability to conduct further processing on imported product.

German retail sales data from GfK-Haushaltspanel indicates that 6% less pork was sold in the first quarter of 2020. This is despite the fact that meat overall was boosted by the leap year, and increased in-home demand due to the restrictions in place from late March.

Although there were reports of disruption in supplying the Chinese market, Germany still shipped 68% more pork and pig offal there than this time last year (+73,000 tonnes). Growth was biased towards January, and slipped a little as the year progressed.

A number of Germany’s major EU markets took less product, preventing export volumes increasing overall. Poland (-9,000 tonnes) and Italy (-8,000 tonnes) in particular took lower volumes. Exports to South Korea were also down by 24% (-7,000 tonnes).

In the first quarter of this year, Germany imported only 2.2 million weaners, 15% fewer than a year earlier. Lower numbers were seen across the quarter, but especially in January, suggesting this trend is not particularly linked to the European coronavirus outbreak. Producer confidence has been reported as poor in Germany for a while, due to the risk of ASF spread and changing welfare regulations. Nonetheless, this could mean production is limited later in the year.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.