GB harvest 2020 nears completion: Grain market daily

Friday, 25 September 2020

Market commentary

- UK feed wheat futures (Nov-20) gained £1.50/t yesterday to £181.50/t, despite trading lower earlier in the day.

- Defra issued their final estimates of the 2020 English crop areas yesterday. The wheat area is now estimated at 1,290Kha (up 22Kha from the provisional release), with the barley area at 1,072Kha (+ 24Kha) and rapeseed area at 351Kha (+6Kha). The English oat area is unchanged at 170Kha.

- The International Grains Council cut its forecast for global maize production by 6Mt to 1,160Mt. This is largely due to issues in the US, with smaller cuts for the EU, China and Ukraine. The cuts are partly offset by lower industrial demand in the US, but stocks are lower. Meanwhile, higher wheat production in Russia and Australia was offset by cuts for Argentina and Canada.

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

GB harvest 2020 nears completion

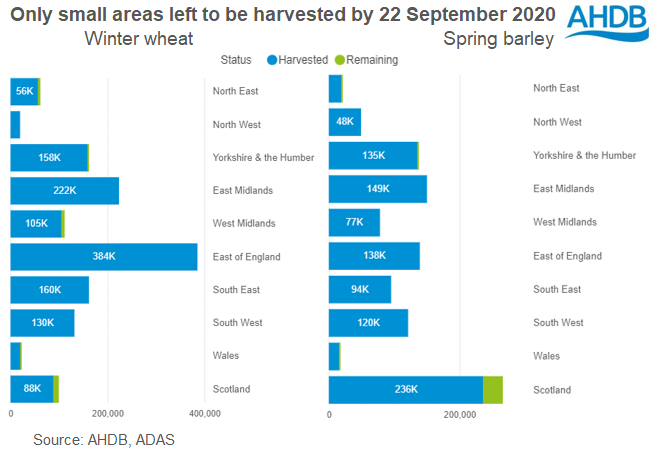

After challenging weather conditions in late August, mainly dry weather in September (so far) has allowed rapid harvest progress to be made. As a result, harvesting in England is drawing to a close and in Scotland there is about 10% of the wheat and spring barley area left to harvest. There are also occasional fields left to harvest in Wales.

However, the lodging that occurred from the heavy rainfall in August created challenges for growers in September. Seed shed was a frequent issue reported amongst lodged crops. Yield estimates for wheat and oats have also edged slightly lower compared to the last report. Harvest progress to WE22 Sept can be summarised as:

- Wheat– 98% complete. GB national yield estimated at 7.1 – 7.3/ha, 13-15% below the 2015-2019 average.

- Winter barley– 100% complete. GB national yield estimated at 6.5 – 6.7t/ha, 6-9% below the 2015-2019 average.

- Spring barley– 97% complete. GB national yields estimated at 5.8 – 6.1t/ha, 1-6% above the 2015-2019 average.

- Oats– 97% complete. GB national yields estimated at 5.1 – 5.3t/ha, 6-10% below the 2015-2019 average.

- Winter oilseed rape– 100% complete. GB national yield estimated at 2.7 – 3.0t/ha, 18-26% below the 2015-2019 average.

There has also been a noticeable change in quality in crops harvested before and after the heavy rainfall. A decline in Hagberg Falling Numbers, as well as specific weights, has occurred in some samples harvested in September. In some late barley samples, a degree of sprouting has occurred, brought on by the rain.

Click here to read the latest harvest progress report in full.

The impact?

The rain in late August seems likely to result in a greater proportion of both wheat and barley crops being suitable for animal feed rather than milling / malting uses.

The concerns over barley specification have been felt in prices recently, with the gap between spot (non-contract) ex-farm prices for premium malting barley and feed barley just over £16/t at a UK level last week, compared to around £13/t a year earlier. This is despite a much larger barley area and uncertainty over malting demand due to the continuing coronavirus pandemic.

With questions over the volumes of later harvested crops meeting certain specifications, increased focus is placed on trade before the end of December; imports for wheat and exports for barley. The UK will exit the EU customs union at the end of December and without a trade deal with the EU, imports of wheat into the UK and exports of barley into the EU will face high tariffs from 1 January.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.