GB animal feed production at 7-year low this season to date: Grain market daily

Wednesday, 6 December 2023

Market commentary

- UK feed wheat futures (May-24) closed at £196.25/t yesterday, down £0.40/t from Monday’s close. The Nov-24 contract was also down £0.40/t over the same period, ending the session at £207.70/t.

- Despite gains in the US wheat market yesterday, domestic wheat futures followed European prices down on the back of weak export demand. According to the European Commission, by 3 December, soft wheat exports from the EU were down 18% this season to date from last season.

- Paris rapeseed futures (May-24) closed at €446.00/t yesterday, down €1.00/t over the session. The Nov-24 contract however was up €0.75/t over the same period, closing at €452.25/t.

- Paris rapeseed futures followed weakness in the wider vegetable oils complex yesterday. Chicago soyabean oil futures (May-24) were down 2% over yesterday’s session. Malaysian palm oil also fell for a fourth session today, reaching their lowest level in more than four weeks (Refinitiv).

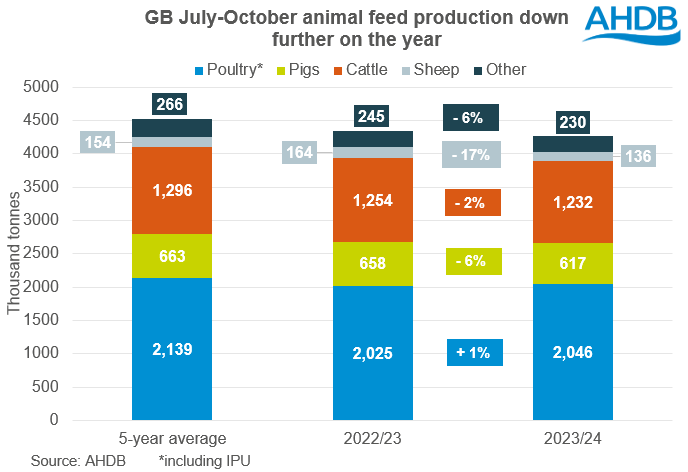

GB animal feed production at 7-year low this season to date

Last Thursday, AHDB published the latest GB animal feed production figures, including information on cereal usage and feed production up to October. The data showed that from July to October this season, total GB animal feed production including integrated poultry units (IPU) was down 1.9% on the year, and at the lowest level since 2016/17. While the majority of animal feed categories are showing year-on-year declines, the key drivers of a fall in overall production are the pig, sheep and poultry compounders (excluding IPU) sectors.

This season to date (Jul-Oct), pig feed production totalled 617.2 Kt, down 6.3% or 41.2 Kt on year earlier levels. Key losses were seen in link/early grower feed (- 14.6 Kt) and pig finishing compounds (- 26.7 Kt). Lacklustre demand from the sector is likely linked to expectations of an ongoing high cost of production. As a result, anecdotal reports suggest that despite contractions last season, it’s unlikely the pig herd will see much expansion this marketing year keeping the demand outlook slow.

For sheep, this season to date (Jul-Oct), feed production is down 17.1% or 28 Kt on the year. For the first quarter of the season at least, demand for sheep feed is largely made up of compounds for growing and finishing sheep. From Jul-Oct, production of compounds for this group was down 21.8 Kt. However, looking ahead, focus will turn to demand of blends and compounds for breeding sheep, which so far is down 6.1 Kt on the year.

As it stands, the poultry sector looks the most optimistic in terms of year-on-year recovery for feed demand. Total poultry feed production (including IPU) is up 1% or 21.1 Kt so far this season, driven by increased production by IPU. However, poultry feed produced by compounders (excl. IPU) was down 2% or 32.4 Kt this season to date compared to 2022/23. Of course, Avian Flu remains a key watchpoint in the sector, and should cases worsen in line with last season, it’s likely feed demand will be impacted.

What does this mean for cereals usage?

So far this season (Jul-Oct), usage of wheat, barley, maize and oats has totalled 1.57 Mt, down 3.6% from the same period in 2022/23. In AHDB’s latest supply and demand estimates released last Tuesday, total cereals demand for animal feed in 2023/24 is forecast at 12.443 Mt, relatively unchanged on the year, but the second lowest level since 2016/17.

In terms of cereal splits, barley is the only cereal that has seen a yearly rise in usage, up 1.9% from July to October, due to its relative price seeing a greater percentage used in the ration. Wheat, maize and oats usage is down 2.7%, 36.4% and 19.9% respectively this season to date compared to 2022/23 levels.

Looking ahead, it’s expected currently that barley will stay firm in rations in the short term but will be priced out by maize and wheat later in the season. As such, full season barley usage for animal feed is forecast relatively unchanged on 2022/23 levels currently, in the UK cereal supply and demand estimates released last month. Full season wheat and maize usage are both forecast up 1% this season from last. Finally, oat usage is not expected to feature heavily in rations for the remainder of the season and is therefore forecast down 21% on the year.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.