Further uncertainty over South American crop expectations: Grain market daily

Friday, 12 April 2024

Market commentary

- UK feed wheat futures (May-24) fell £1.00/t yesterday, closing at £170.00/t. The Nov-24 contract ended the session at £194.25/t, down £0.25/t over the same period.

- Domestic wheat futures followed EU prices down, as traders adjusted positions ahead of yesterday evening’s USDA World Agricultural Supply and Demand Estimates update. A lull in European export demand, as well as cheaper Black Sea supplies as of late also continue to pressure prices (LSEG).

- May-24 Paris rapeseed futures (May-24) were down €1.75/t from Wednesday’s close, ending the session at €451.50/t. The Nov-24 contract fell €5.00/t over the same period, closing at €461.75/t.

- Paris rapeseed futures followed the wider oilseeds complex down yesterday as weakness in the soya oil market filtered through. Warm and beneficial weather in Ukraine has also improved the country’s rapeseed outlook. LSEG now forecast Ukraine’s 2024 rapeseed crop to reach 3.8 Mt, up 0.1 Mt from March’s estimate.

Further uncertainty over South American crop expectations

Yesterday saw the release of the USDA’s latest World Agricultural Supply and Demand Estimates (WASDE). There were also updates from the Buenos Aires Grain Exchange concerning Argentinian crops, and Conab concerning Brazilian crops. While some adjustments were made in yesterday’s WASDE, the USDA continues to show significantly different estimates to its Brazilian and Argentinian counterparts.

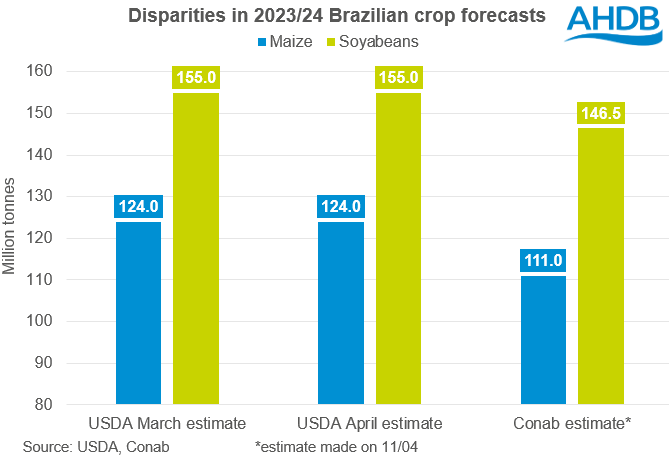

Brazil

Ahead of yesterday’s WASDE update, in a Reuters pre-report poll, analysts on average expected the USDA to revise the Brazilian soyabean crop to 151.7 Mt. However, in the update, the USDA estimated 2023/24 Brazilian soyabean production at 155.0 Mt, unchanged from the previous month. This remains much higher than Conab’s latest estimate, which now sits at 146.5 Mt.

For maize, analysts had predicted that the USDA would revise its estimate of the 2023/24 Brazilian crop to 121.8 Mt. Though again, the forecast was left unchanged from March at 124.0 Mt. This is now 13.0 Mt above Conab’s estimate of 111.0 Mt.

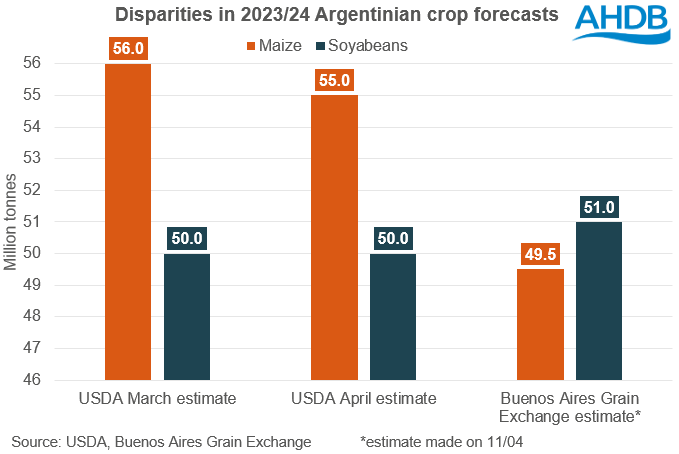

Argentina

In the Reuters pre-report poll, analysts had on average expected Argentinian soyabean production for 2023/24 to be revised up slightly by the USDA to 50.5 Mt. However, in yesterday’s WASDE, production was pegged at 50.0 Mt, unchanged from March. This is slightly below the Buneos Aires Grain Exchange’s estimate of 51.0 Mt, which was revised down from 52.5 Mt yesterday on the back of dry weather and the impact that late plantings is starting to have on development.

Analysts had expected Argentina’s maize crop to be revised down 0.4 Mt to 55.6 Mt in yesterday’s WASDE. In fact, the USDA cut 1.0 Mt off its estimate, meaning the maize production estimate now sits at 55.0 Mt. Despite the cut, this estimate is still above the Buenos Aires Grain Exchange estimate of 49.5 Mt. A further cut of 2.5 Mt was made to the exchange’s figure yesterday, after reports of unprecedented damage from Spiroplasma, carried by leafhoppers in the country.

Market reactions

Given that soybean supplies were estimated heavier than expected in yesterday’s report, Chicago soyabean futures (May-24) were pressured slightly over yesterday’s session (- 0.5%), though Conab’s revision likely limited any major losses.

For maize, as with soyabeans, market reaction yesterday was minimal. May-24 Chicago maize futures were pressured down 1.3%, with the cuts made in Argentina and concerns over Spiroplasma likely outweighing the lack of adjustment to the Brazilian maize crop by the USDA.

Looking ahead, uncertainty over the size of the South American maize and soyabean crops continues, though overall supplies remain historically high. We could however see some rallying in prices should disease concerns rise further in Argentina.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.