Further UK rapeseed price risk from US soyabean harvest? Grain market daily

Tuesday, 29 September 2020

Market commentary

- After setting another new contract high on Friday, UK wheat futures (Nov-20) eased back yesterday. The Nov-20 contract closed at £181.80/t, down £0.95/t from Friday. However, May-21 prices fell £2.70/t, to £180.05/t, creating a negative carry between the nearest May and Nov contracts for the first time since August 2018.

- Sterling was a key influencer on UK futures, gaining 0.4% against the euro to £1 = €1.1000 and 0.6% against the US dollar to £1 = $1.2827 (Refinitiv). However, there was a wide range in trading during the day and sterling traded as high as £1=$1.2925, while Nov-20 UK wheat futures traded as low as £179.00/t.

- Winter wheat planting in the US reached 35% complete by 27 September (USDA) amidst favourable weather conditions, just ahead of average (33% complete) for this time of year. The US maize harvested also advanced to 15% complete, just behind average (16%).

- Our Grain Market Outlook conference is completely online this year on the 13th October and free to see! To book your space to view it live and receive the recording afterwards, click here.

Further UK rapeseed price risk from US soyabean harvest?

UK delivered rapeseed prices fell sharply last week (Friday-Friday) following declines in Paris rapeseed and Chicago soyabean futures. Yesterday’s Market Report highlighted that part of the reason for this fall was good weather in the US Midwest allowing the US soyabean harvest to progress.

Last night the USDA confirmed that as at 27 September, 20% of the US soyabean crop had been harvested, ahead of 15% on average over the past 5 years. Progress was also towards the upper end of industry expectations according to a pre-report poll by Refinitiv.

Did the funds contribute to last week’s price fall?

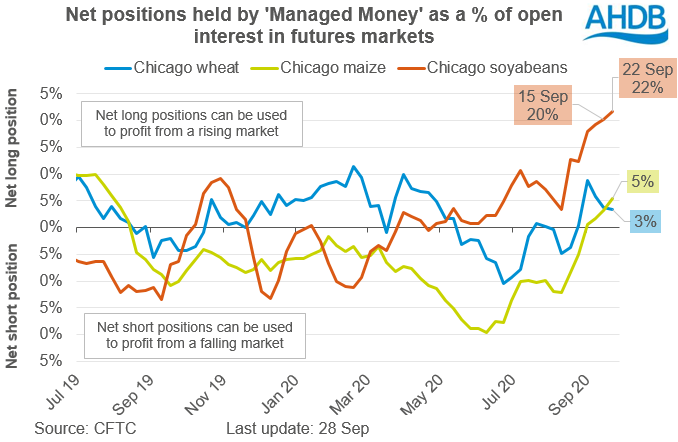

The positions taken by speculative traders (funds, shown as managed money below) in the futures markets have the potential to exacerbate any short term fall in prices. When the funds hold net-longs and there’s a sustained price fall, it can trigger speculative traders to re-position by selling some of their previously bought contracts. A sell-off can add momentum to a fall in prices or exacerbate the extent of the fall.

The latest data shows that, as at Tuesday 22 September, funds held very large net long positions in Chicago soyabean futures. Chicago soyabean prices fell $6.34/t between 22 and 25 September, and lost another $2.30/t yesterday. Reports from Refinitiv suggest that some re-positioning has taken place since 22 September and this, in my opinion, likely contributed to the falls in Chicago soyabean and so UK rapeseed prices last week.

However, these report indicate that it’s likely that speculative traders still hold sizeable net longs, perhaps comparable to Tuesday 8 or 15 September. This means there’s a risk of a further sell off and so downward price pressure if the fall continues.

Where next?

There’s potential we could see further pressure on prices as the US soyabean harvest gathers pace. There’s very little difference (carry) between spot and forward prices, which is incentivising US farmers to sell rather than store their soyabeans and could pressure spot prices.

However, this will also depend on weather conditions in South America, where planting is starting. Large areas are expected to be planted with soyabeans in Brazil and Argentina because prices are favourable compared to other crops. However, there’s risk from the current drier than usual weather so this isn’t yet certain.

In the short term, Wednesday’s data on US grain and oilseed stocks as at 1 September may also influence prices.

Any further pressure on soyabean prices could add drag rapeseed prices lower too, including in the UK.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.