Further gains in new crop futures to be hard won: Grain Market Daily

Tuesday, 19 November 2019

Market Commentary

- The maize outlook remains bearish as US export pace lags. US accumulated exports for the season so far, at just 4.5Mt, are less than half the volume exported at the same point last season.

- Although harvest difficulty in the US is still ongoing, the minimal export pace is outweighing potential crop production downgrades. US Managed Money funds further extended their net short position last week, expecting prices to become pressured further.

- As the global grain market becomes pressured, further gains to UK markets will become harder to realise. UK feed wheat futures (May-20) fell yesterday, closing £1.25/t below the recent highs recorded on the 14 November.

Further gains in new crop futures to be hard won

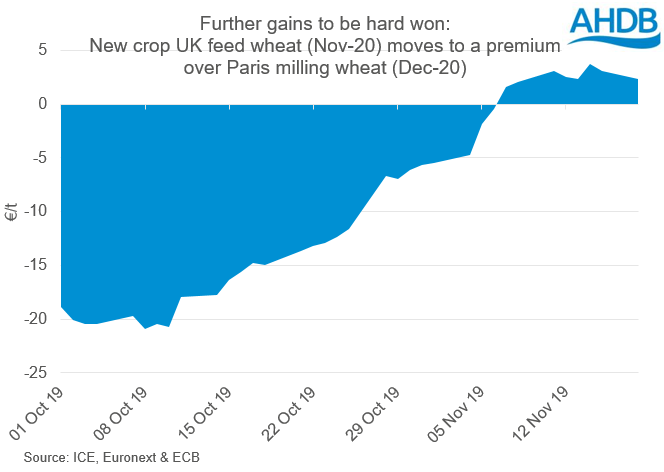

There are now signs that new crop UK feed wheat futures have begun to reach an import ceiling.

For four weeks from the 10 October, UK feed wheat futures (Nov-20) gained relative to Paris milling wheat futures (Dec-20). Yet, having risen from €20.70/t (£18.66/t) below French futures to a €3.09/t (£2.65/t) premium, this relationship has been unable to stretch further as the competitiveness of domestic wheat with alternative imported wheat or maize diminishes.

With new crop futures now somewhat prevented from gaining further relative to European origins, there are two main risks for new crop pricing for the foreseeable.

Exchange rate and global market sentiment

While new crop prices have been gaining relative to European markets, the gain in the value of the pound has gone somewhat unnoticed.

Relative to the euro, the value of the pound has increased from £1=€1.11 on 10 October to then trade in a narrow range around £1=€1.16 from 15 October to 8 November.

Yet last week has seen a further gain, with the value of the pound breaking out of the previous narrow trading range to break £1=€1.17 on 14 November and again yesterday (18 Nov). Should further gains be recorded as exchange rate trading factors in economic and political outlooks, then UK markets could well become pressured in pound terms.

Globally, wheat and maize markets have also been drifting. Driven by large stocks and export competition. Both Paris and Chicago new crop wheat futures (Dec-20) have lost ground from highs in October, down €3.25/t and $8.36/t respectively.

Unless global market sentiment returns to a bullish outlook then then UK futures markets risk beginning to feel the drag of a well-supplied global outlook. With futures markets facing potential pressure, changes to physical relationships to futures will become increasingly important and may well stretch further in regions of deficit.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.