French wheat crop drags on UK prices: Grain Market Daily

Wednesday, 7 August 2019

Market Commentary

- UK feed wheat futures (Nov-19) lost further ground yesterday in spite of the continued decline in sterling.

- Nov-19 futures closed £1.30/t lower, at £143.50/t. The latest fall sees futures break through the previous support line at £144.50/t, the prior “low” set on 9 July. The next support line is now set at £141.00/t (13 May).

- The fall in UK feed wheat futures tracked a larger fall in the value of Paris milling wheat futures (Dec-19); the French wheat market lost €2.00/t yesterday to close at €175.50/t.

- The move lower was driven by further forecasts of large French crops.

French wheat crop drags on UK prices

- French farm ministry has upped its estimate of soft wheat production.

- EU exports have been slow out of the blocks this season. EU export prices may need to move lower to find demand.

- Big UK crop expected meaning UK prices will track French and other export origin prices.

Yesterday the French farm ministry upped its estimate of soft wheat production by a further 1.2Mt from its July estimate. The ministry now forecast French production to reach 38.2Mt, up 12% year-on-year, the largest French soft wheat crop since 2015 (EU commission – 40.9Mt).

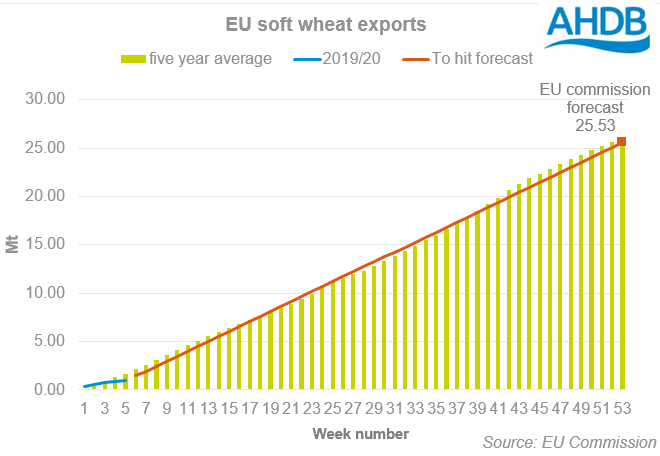

The latest increase in French production further highlights the need for EU wheat to price competitively on the global stage this season. According to EU commission data, EU exports of soft wheat have been slow out of the blocks this season. In the five weeks to 5 August, just 929Kt of soft wheat had been exported from the EU, some 473Kt less than at this stage last year.

That said, EU wheat is showing early signs of competitiveness against other origins, in its latest tender Egyptian state grain buyer, GASC, purchased 415Kt of wheat including 60Kt of Romanian wheat. Romania has so far accounted for the majority of EU exports this season.

With a big crop expected, EU export prices, and French prices in particular, will be watched closely. Last week French Grade 1 (11% protein) wheat for August shipment was quoted at $192.40/t, $4.40/t more than Russian 11.5% wheat. This suggests that French prices may well need to move lower to continue to find export demand. That said, Russia’s production and export picture has tightened slightly in recent weeks, which could limit how far French prices need to fall.

With a bumper wheat harvest also expected in the UK, a move lower in French/ EU wheat prices is likely to be echoed in UK markets. The UK will need to price competitively against other export origins in order to attract demand.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.