Fertiliser prices continue to drop: Grain market daily

Wednesday, 12 July 2023

Market commentary

- UK feed wheat futures (Nov-23) closed yesterday at £195.40/t, gaining £1.65/t on Monday’s close. The Nov-24 contract closed at £198.45/t, gaining £1.60/t over the same period.

- Our domestic market followed up both the Chicago and Paris wheat markets yesterday.

- The Chicago market rose on worries over the Black Sea Initiative not being extended, which is set to expire on 17 July. Further to that, there was a surprise drop in US spring wheat crop ratings. The USDA reported that 47% of the US spring crop is rated good-to-excellent to week ending 09 July, down from 48% a week ago. The Paris market shadowed these gains, as there was also mix indications on Northern Hemisphere crops as there was some reports on France’s initial harvest yields not being as good as expected (Refinitiv).

- Paris rapeseed futures (Nov-23) closed yesterday at €466.25/t, gaining €7.00/t on Monday’s close. Rapeseed gained from both support in Brent crude oil markets and Chicago soyabeans. Chicago soyabeans continued to gain yesterday on expected cuts due in this evening’s upcoming USDA report, (read more information here) this is to reflect the latest USDA acreage report

Fertiliser prices continue to drop

Since our last update fertiliser prices have continued to fall, with 2023 prices gradually coming back down closer to comparable prices seen in 2021, albeit still historically high though.

Spot prices for UK produced Ammonium Nitrate (AN) averaged £344/t in June, down 12% from May, according to latest AHDB data. This is down 55% from the same time last year but remains 16% higher than in June 2021.

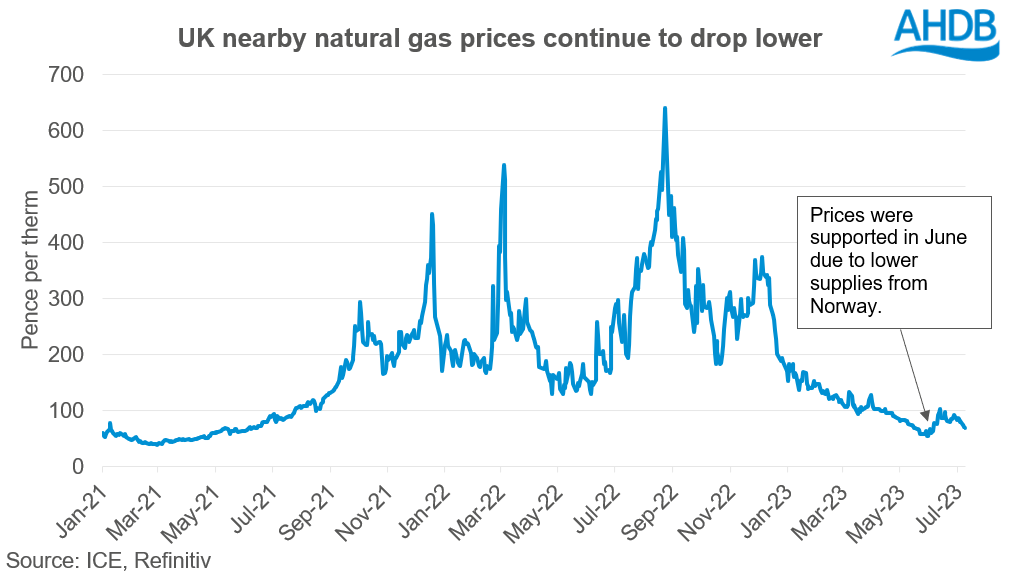

Despite the uptick in nearby UK natural gas futures over the month of June, domestic fertiliser prices continue to fall from the historical highs seen last year, and this continues to be reflected in the imported AN price too.

The recent gain in prices throughout June was a result of longer-than-expected maintenance outages at key gas plants in Norway. This has meant that production has been lower than planned. This recent price increase over June just goes to show how sensitive the European and UK gas market is to disruption, as reliance from Russia has reduced following sharp cutbacks amid the war. Further to that, natural gas prices were supported as Netherlands plans to permanently shut its Groningen gas field in October.

However, since the start of July prices have felt pressure again, closing yesterday at 70.51 p/therm, which is slightly lower than the same point two years ago. Reasons for the pressure in July is due to the strong supply from Norway, with the return of some infrastructure following the maintenance mentioned above.

Further to that, high gas storage levels in Europe has weighed on prices. The rate of accumulating stocks level ahead of winter is likely to keep natural gas prices under pressure for the rest of the Northern Hemisphere summer, so it’s estimated that there will be a further downside in prices in the coming months (Refinitiv).

What does this mean?

This means that we could possibly see a continued fall in fertiliser prices, if we continue to see a drop in natural gas prices. Although natural gas prices are not as low as they were two years ago, they have started to edge down to that point. In June though, we saw disruption to supply can also create price volatility and a continued drop in prices will ultimately depend on the Northern Hemisphere weather as we enter the winter months.

With inputs into producing the 2024 harvest being procured, and the recent drop in energy and inputs along with Nov-24 UK feed wheat futures closing at £198.45/t yesterday, could this moment pose a good marketing opportunity for a proportion of grain? Something to think about, especially as formulating an accurate cost of production or breakeven point is clearer through the year.

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.