Factors facing the spring barley crop: Grain Market Daily

Friday, 10 January 2020

Market Commentary

- Markets await a combination of important USDA reports that will be released later today at 17:00 GMT. Amongst the data dump is the final production numbers for the US soyabean and maize crops that will detail the effect of a difficult growing season. Pre-release polls indicate markets expect declines to production. The latest world supply and demand estimates (WASDE) and key US winter wheat plantings data are also due later today.

- China have reportedly purchased 10 cargoes of Brazilian soyabeans for delivery between January – April, ahead of the US-China ‘phase-one’ deal signing next week. Chicago soyabean futures have firmed this week, ahead of the deal signing scheduled for 15 January.

Factors facing the spring barley crop

A difficult window for winter planting has meant many face increasing spring acreages. Spring barley seems a likely choice for spring drilling options. AHDB’s Early Bird Survey of planting intentions, points towards a 30% increase in spring barley area from last year.

Barley supply globally is at surplus levels. EU barley production in the 2019/20 season is estimated at 63.0Mt, an increase of 7.0Mt on last year. Black Sea barley production also saw increases, leaving a large amount of barley available nearby to UK markets. As mentioned yesterday, awareness of a grain marketing plan is key to potentially boost returns.

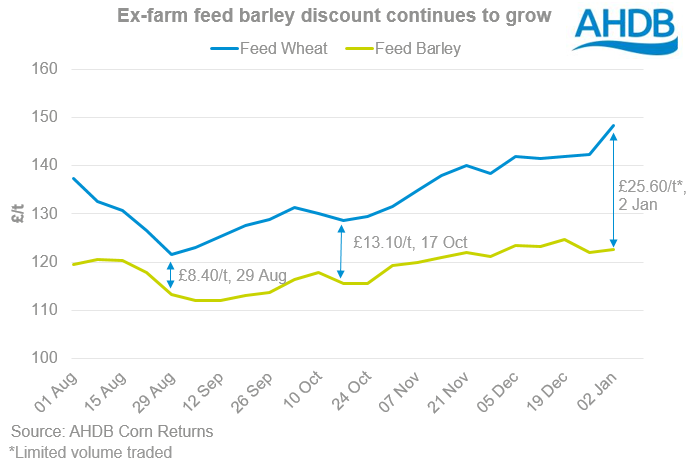

The relatively comfortable barley supply situation is pressuring feed barley prices to trend lower. The latest UK corn returns (02 Jan) show UK feed barley at £122.70/t, a discount of £25.60 against feed wheat, the largest discount since June, albeit with limited volume traded. The spread has continued to widen this season as barley seeks to remain competitive in export markets. The worries surrounding the new wheat and barley crop have propped up prices to an extent, though, better weather going forward, if seen could begin to ease concerns.

Some domestic demand has increased in light of pressured barley prices. Animal feed production (including Integrated Poultry Units) in the season to November used 9.3% more barley than in the same period in 2018. Similarly, barley usage by brewers, maltsters and distillers was up 2.7% across the same period, as malting premiums decrease.

UK export pace for barley is lagging behind required levels, meaning a potentially large carryover of old-crop barley is likely to meet the new crop. With a deal not formally agreed, Brexit remains a watch point for barley markets. Barley export levels will need to pick up going forward as reportedly little barley trade has been completed since the start of November.

Akin to recent seasons, the presence of a large Ukrainian maize crop on the EU market’s doorstep may likely cap barley price gains in feed markets.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.