European winter crops faring well despite dryness concerns: Grain market daily

Tuesday, 21 March 2023

Market commentary

- UK feed wheat futures (May-23) closed at £204.50/t yesterday, down £5.00/t from Friday’s close. The Nov-23 contract closed at £214.50/t, down £3.70/t over the same period.

- Global wheat markets lost ground yesterday after the Black Sea grain export deal was extended over the weekend for at least 60 days. However, Russia have warned that any further extension would depend on the removal of some Western sanctions.

- Paris rapeseed futures (May-23) also continued to decline yesterday, closing at €453.75/t, down €13.30/t from Friday’s close. New crop futures (Nov-23) lost €13.25/t over the same period, closing at €462.50/t.

- Pressure within the wider oilseed complex, as well as weakness in rape oil markets are weighing on rapeseed prices.

European winter crops faring well despite dryness concerns

Recently markets have been reacting to updates from the Black Sea region, as well as Southern Hemisphere production. However, as we move towards harvest 2023, focus is turning to the development of Northern Hemisphere crops. Yesterday, the European Commission released their March crop monitoring report, including its first yield estimates for harvest 2023. The size and quality of European crops can impact UK prices and domestic export potential, so how are winter cereals in Europe faring so far?

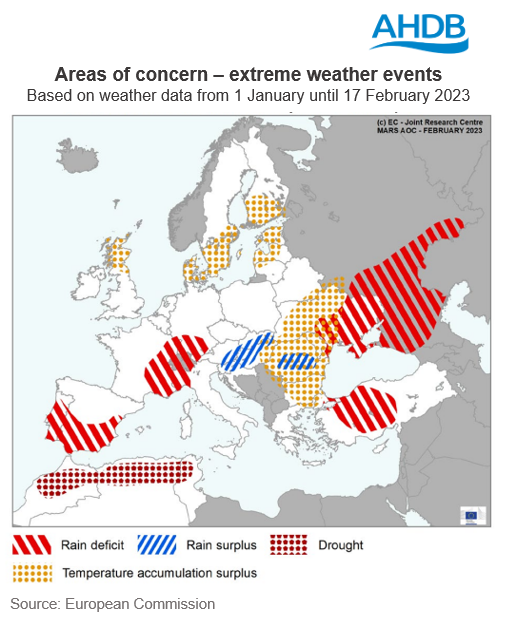

Dry weather remains a concern in certain regions

In most key-producing regions in Europe, following the mild winter, cereal crops are generally said to be in fair to good condition. Having said this, the dry conditions in southern parts of the continent are becoming increasingly concerning. An extreme rain deficit and even drought can be seen in certain parts of Spain and Portugal, with soil moisture levels very low and rainfall desperately needed.

As well as soil moisture concerns, water reservoirs for irrigation in most of southern Spain and northern Italy are very low, which could have an impact on spring cropping decisions, and the ability to irrigate during late spring and summer. According to the report, some intended maize area could be partially replaced by sunflowers for example. Elsewhere in Europe, rainfall deficits are also observed in Hungary, Austria, Romania, Bulgaria, Greece and Cyprus. While the deficit is less severe in these regions and crops are in good condition, more rainfall is still needed to meet the increasing crop water demands as the season progresses.

In most of France, Southern Germany and the United Kingdom, the rainfall deficit that was seen mid-January has been alleviated by well distributed rainfall in March, with more rain expected in these parts across the next week too.

What does this mean for yields and production prospects?

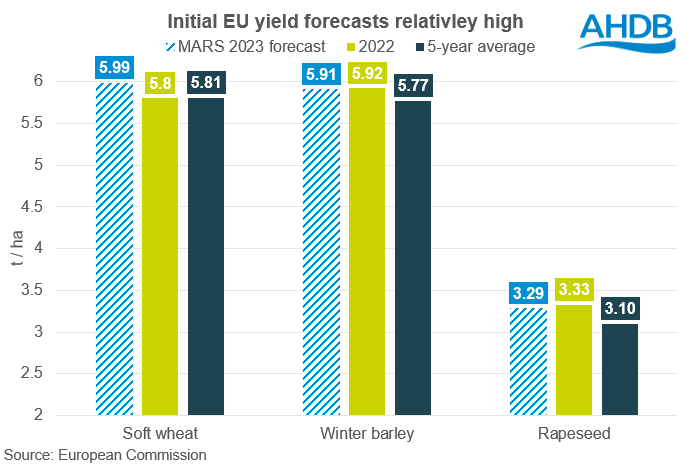

As it’s still early, the crop yield forecasts in yesterday’s report are largely based on historical trends. There is still plenty of room for estimates to change from this point depending on weather conditions up until harvest.

The initial yield for soft wheat for the EU is pegged at 5.99t/ha by the European Commission. If realised, this would be up 3% on the five-year average, and up 3% on the year. The winter barley yield estimate in the EU currently sits at 5.91t/ha, in line with harvest 2022, and up 2% from the five-year average. The EU rapeseed crop also seems to be faring well, with the yield estimate pegged at 3.29t/ha, up 6% on the five-year average, but down slightly (1%) on the year.

Looking towards next season and new crop prices, even with areas of rainfall deficit and drought, most of Europe looks to have strong production prospects at this point in the season, with most crops faring well. As spring drilling progresses and winter crops develop, the weather will remain an important watchpoint moving forward, with more rain needed in some southern areas to mitigate concerns.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.