European wheat yields slip despite rain: Grain Market Daily

Tuesday, 28 July 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £166.90/t, down £1.85/t on Friday’s close. Paris milling wheat futures (Dec-20) were also down €3.00/t on Friday, closing at €183.50/t.

- Pressure was also recorded in Chicago wheat futures (Dec-20), which were down $3.86/t, closing yesterday at $196.49/t.

- This pressure across the board was due to IKAR increasing its forecast for Russia’s 2020 wheat crop to 78Mt from the previous forecast of 76.5Mt, after high yields in some regions.

- UPDATE: Our Planting and Variety Survey now includes GB uncropped arable land and temporary grassland for 2020, click here to find out more.

European wheat yields slip despite rain

Many farmers across Europe have probably had a growing season they would rather forget, from a wash away autumn and winter in parts, met by a hot and dry spring. The latest EU crop monitoring (MARS) report, released yesterday, reported that there is a sustained positive outlook for spring crops due to recent substantial rainfall. However, this rain has had mixed effects on yield forecasts for winter crops.

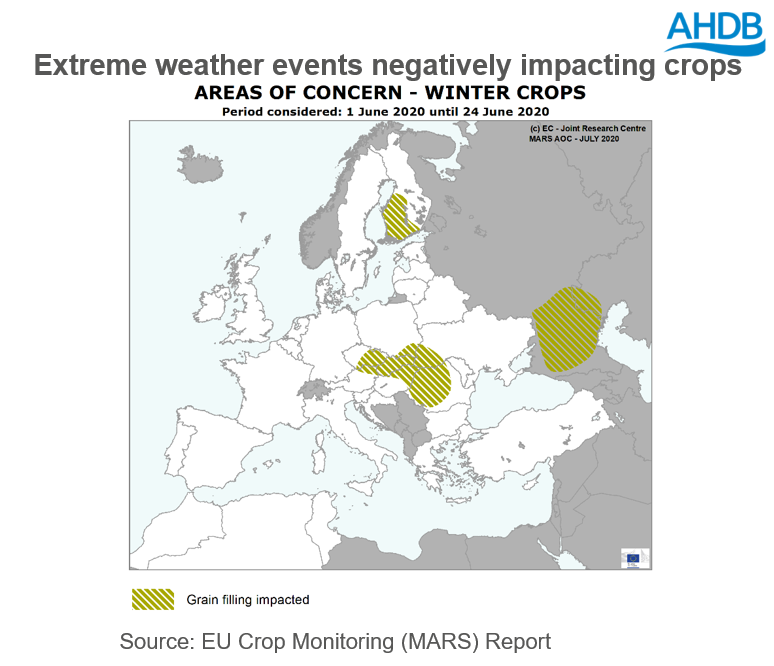

Although there has been a recent positive outlook in general, which has improved general yield outlook on the last MARS reports, there is cause for concern on winter cropping in much of central Europe, south-western Finland and southern Russia.

Favourable weather conditions contributed to an improved wheat yield outlook across several regions in Europe. However, the EU-27 forecast for soft wheat was slightly revised further downwards, forecasted at 5.54 t/ha, down 1.1% on June’s forecast and 3.9% on the five-year-average.

This was mainly due to the sharp downwards revisions of wheat yield forecast in Romania, Bulgaria and Hungry after recent heavy rain around the time of the crop ripening. This has outweighed the slight upward revisions in most other countries.

Further to that, hot and dry conditions in southern and south-western Russia led to limited water supply and weakened biomass accumulation, negatively impacting both winter and spring wheat yields. Weather in key Russia spring cropping areas will be a focus point now.

How will this affect domestic growers?

What Europe produce will be a key influence to our domestic pricing as we start this marketing year, due to us trading at import parity. Although Europe’s production will be down year-on-year, they will still have to maintain competitive to export their surplus, which will inherently impact UK prices.

Recent weather in the Europe has provided a beneficial end to crops in places such as France and Germany and has prevented further yield losses for crops in general. However, weather in Eastern Europe and Southern Russia has imbalanced that positive and will need to be monitored. Smaller than expected crops in these regions could support prices, while larger ones could add pressure.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.