EU wheat production estimates hit after torrential rain

Tuesday, 17 March 2020

Market Commentary

-

Despite large-scale declines in economic markets, UK wheat futures (May-20) increased to close yesterday at £150.65/t, up £1.15/t from Friday. New crop UK futures (Nov-20) also saw an increase of £1.15/t from Friday to close at £161.30/t as both contracts benefited from a weakening sterling.

-

China was absent from US weekly soyabean export inspection data published yesterday, a first since December 2018. The ongoing Brazilian soyabean harvest has swayed Chinese purchasers to opt for the cheaper alternative, despite the US/China phase-one deal agreement. US soyabean futures (May-20) fell $9.92/t yesterday to close at $301.91/t from Friday.

EU wheat production estimates hit after torrential rain

The European association Coceral revised its 2020/21 cereal production estimates from initial forecasts last month in a report released yesterday.

The likelihood of an increased spring barley area in the UK this season has bumped up the Coceral EU-28 barley production forecast, which is now estimated at 61.8Mt, up 1Mt on forecasts published last month.

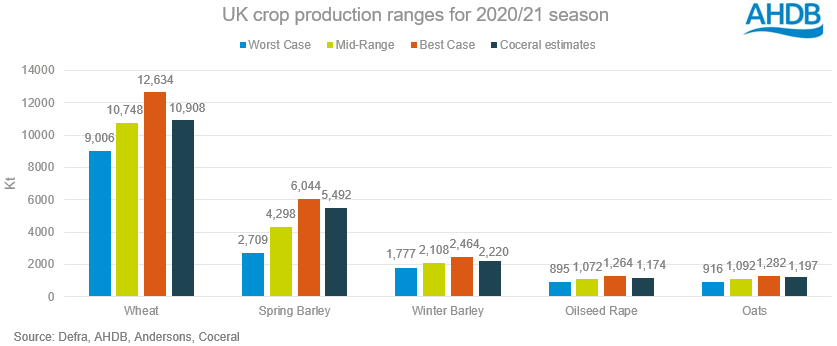

The Coceral production figures for the UK largely fall in line with our mid-range production estimates published last month and can be viewed in the graph below. The Coceral planted area estimates align closely with our Early Bird Survey estimates also, further confirming a wider view on where the UK likely is for production. Coceral estimate the UK wheat area at 1478KHa with a yield of 7.38t/ha, 26KHa below our EBS estimates.

For the EU + UK, soft wheat production was lowered 1.4Mt to 136.5Mt due to persistent torrential rain disrupting sowing and affecting crop conditions. This is significantly down on last year which was recorded at 145.7Mt. With a reduced wheat production figure, crop conditions will be an important focus for milling quality amidst the frequent rainfall. The French soft wheat crop in particular is estimated at 63% good to excellent, down on last year’s rating of 85% for this point.

With reduced wheat production figures, a greater volume of grain imports into the EU + UK may be seen. Though, the degree to which will also depend on the EU + UK maize production figure. Coceral estimate this at 65Mt, up on last year by 4Mt. With delays to spring planting seen, increases to the EU maize area could theoretically be likely.

Ukraine is a leading presence for EU import origins and likely will be for the upcoming season. So far this season, Ukraine has accounted for 26.5% of EU soft wheat imports and 56.8% of EU maize imports.

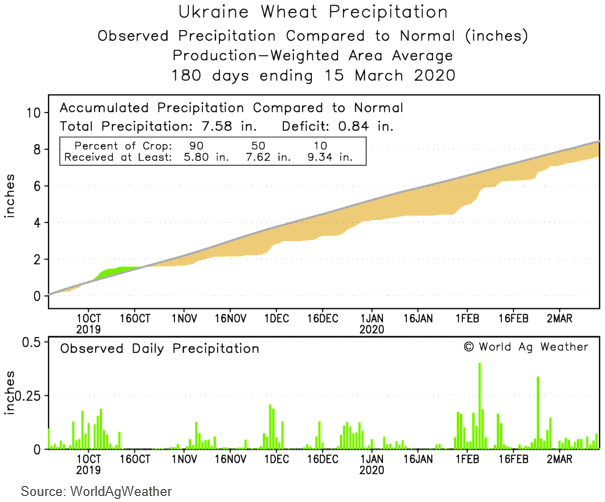

According to the Ukrainian grain traders union (UGA), winter wheat production will likely hit 25.8Mt, from 28.2Mt last year, owing to a reduced planted area. A lack of substantial rainfall over winter has significantly affected soil moisture levels, though recent rainfall across the country has replenished some reserves. As of 9 March, 90.7% of the winter grain crop was rated as ‘good condition’.

Disruptions to the main EU import origin would likely benefit domestic prices, given the increased need for imports this season in the EU. Crop conditions in Black Sea regions must remain an important watch point as positive news will offer pressure to import parity levels.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.