EU prices lower, led by weak German market

Tuesday, 3 August 2021

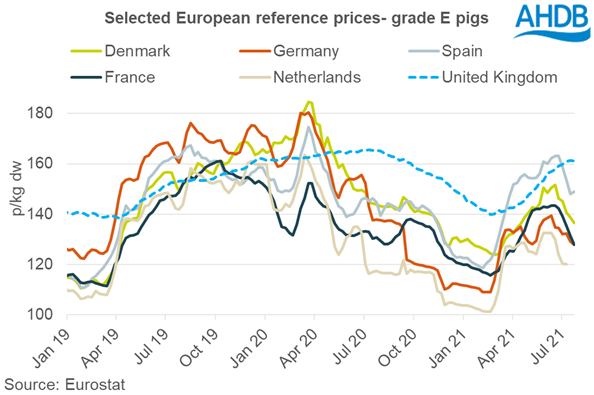

EU pig prices continue to soften, with none of the major producing countries immune to bearish trading conditions in recent weeks. Prices across markets peaked around mid-June.

These downward movements in the EU market increase the discount of the EU average price to the UK reference price. The GBP/EU exchange rate has been creeping up too. This makes EU pork cheaper for UK importers, further increasing the competitiveness of EU product. In the latest week’s data ending 25 July, in sterling terms, the EU average price was about 130p/kg, more than 30p lower than the UK reference price.

Overall, the EU average pig reference price has fallen by more than €9 to €151.5/100kg, over the four weeks to 25 July. Even so, prices are still just above year-earlier levels, although high feed prices will mean the same cannot be said for pig farm profitability.

The German market intelligence organisation, AMI, continues to report that demand for German pork remains low, with supplies more than enough to meet it. There is still less out-of-home demand due to coronavirus restrictions. German slaughterhouses are apparently suffering from negative margins and so demanding significant price discounts. Against this background, the supply of pigs seems to be increasing, although remains low overall.

More widely in the EU, AMI similarly reports that supplies of slaughter-ready pigs remain small, while demand in general is also subdued. Prices in Spain have been softening, likely an indicator of weakening prospects on the EU’s main export market, China. Indeed, Rabobank reports that Chinese pork prices are now low enough to deter some imports.

At home, price gains in the SPP have been slowing recently. Some plants have cut killing days as they struggle with staff numbers, and EU product is becoming increasingly discounted to domestic pork. It is very hard to imagine that the GB price measure will not start to post declines soon.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.