EU pig prices remain stable

Thursday, 27 August 2020

By Felicity Rusk

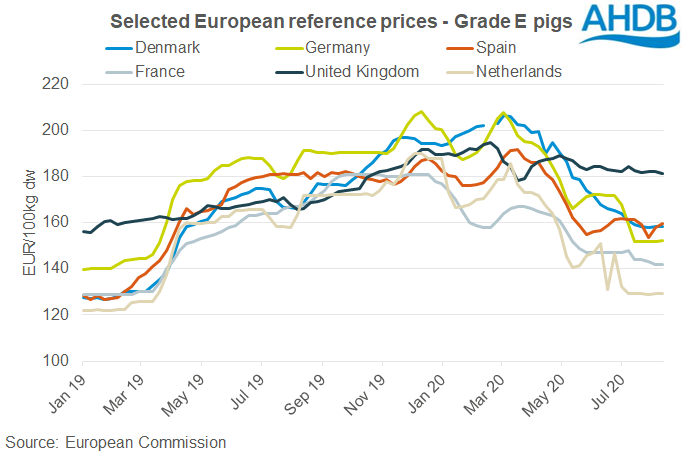

Since our last update, EU pig prices have remained relatively steady. Combined challenges in processing capacity, as well as heavier average carcase weights, has weighed on markets. This price pressure has also been felt in weaner markets. Nevertheless, there is optimism that the backlog of pigs will be worked through in the coming weeks and carcase weights are reportedly now falling. Reports indicate that orders from China are increasing, and some of the coronavirus-related disruption to this trade has eased. Altogether, this may provide some upward support to prices in the future.

In Germany, the major Tönnies processing site has now resumed operations following a one-month closure due to a COVID-19 outbreak among the workforce. According to AMI, the slaughter of around 4 million pigs was directly affected. On 17 August, the Chinese authorities granted permission to export again, and so trade is expected to resume in the near future. Supplies are reportedly meeting demand; however, there are some regional differences.

Meanwhile, in Denmark, the Danish Crown plant at Ringsted halted operations for two weeks during August following an outbreak of COVID-19 amongst staff. The plant accounts for around one-fifth of the pigs processed in the country, however, pigs were able to be re-directed be other facilities. The plant has since reopened at 50% capacity, although exports to China have been temporarily suspended. Reports suggest that demand is subdued due to the limited activity in the foodservice sector. Nevertheless, supply is meeting demand and that has resulted in price stability.

Pig prices in Spain have bucked the trend, and have moved up by over €6/100kg since the start of the month. Exports to China have been particularly strong. In June, exports of fresh and frozen pork reached 68,400 tonnes, over 200% more than in the previous year. This has likely been supported by the growth in pig production seen in the nation. However, the export price of pork to China has dropped back by 16% since March, which has likely capped price rises.

In France, demand is reported as good, supported by sales campaigns. Lower average slaughter weights could indicate that supplies of available pigs are now slightly short.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.