EU maize yields slashed again: Grain market daily

Tuesday, 23 August 2022

Market commentary

- Yesterday, the Nov-22 UK feed wheat futures contract gained £3.60/t from Friday’s close, settling at £260.85/t. The Nov-23 contract closed at £244.35/t, gaining £3.35/t over the same period.

- Wheat markets are being supported by upward movements in global maize prices, due to hot dry conditions in both the US and EU – read more below.

- Nov-22 Paris rapeseed futures gained €21.25/t from Friday’s close, settling at €622.75/t yesterday. Worries over gas supplies in Europe have caused the euro to fall compared to a strengthening dollar, making Paris rapeseed more attractive on the global market.

- Today, the Nov-22 UK feed wheat futures contract is trading higher at £265.75/t whilst the Nov-22 Paris rapeseed futures contract is trading lower at €620.75/t (prices as at 15:44).

Crop performance results: past, present, and future

Yesterday, AHDB Lead Analyst for Farm Economics, Mark Topliff, published a piece of analysis using Farmbench data to show how different crops performed in 2021 and provide costing estimates for 2022, as well as a forecast for 2023. With rising input costs and a grain price volatility, take a look at this analysis to see what margins may look like next year.

EU maize yields slashed again

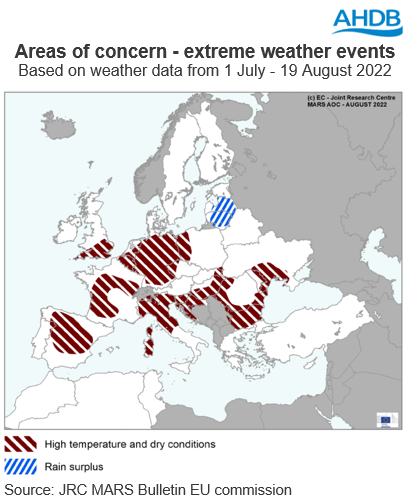

Continued hot and dry conditions across the EU, has led to yield outlooks for 2022/23 summer crops being cut further by the European Commission (EC) in its latest crop monitoring report (MARS) released yesterday. Grain maize yields for the bloc are now forecasted at 6.63t/ha, down 9% from July’s estimate and 16% lower than the five-year average.

In their cereals supply and demand estimates, released at the end of July, the EC have maize production for the bloc pegged at 65.83Mt for 2022/23. This is based off a yield of 7.22t/ha and a planted area of 9.12Mha. However, if we take the latest maize yield forecast from the MARS report and apply it to the EC’s area, EU maize production would be 60.45Mt. This is over 5Mt lower than what is currently forecast. If realised, this would be the lowest EU maize output since 2015.

Similar hot and dry conditions in the US are also causing concern over the condition of its maize crop, with the USDA cutting its crop condition scores again this week. 55% of the US maize crop was rated ‘good’ to ‘excellent’ as at 21 August, down 2 percentage points from the previous week.

Uncertainty around this season’s global maize crop is adding support to grain markets, with maize acting as the price floor for other cereals including wheat.

Changes to weather in both the EU and US will be a watchpoint for global grain markets over the next few weeks until the actual impact of the hot and dry conditions is assessed when harvest starts.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.