EU 2023/24 grain outlook: Grain market daily

Thursday, 16 February 2023

Market commentary

- UK feed wheat futures (May-23) closed at £242.00/t yesterday, down £3.00/t from Tuesday’s close. The Nov-23 contract closed at £238.50/t, also down £3.00/t over the same period.

- Domestic prices followed global market movement down yesterday, after concerns in the US economy, regarding hikes in interest rates, saw US wheat markets weaken. However, major losses were curbed by ongoing fears about the future of the grain export corridor in Ukraine.

- Chicago soyabean futures (May-23) also felt some pressure yesterday, closing at $558.26/t, down $3.86/t from Tuesday’s close.

- US soyabean markets are reacting to the ongoing harvest of Brazil’s bumper crop, with AgRural saying on Monday that the harvest was 17% complete.

- Paris rapeseed futures (May-23) followed soyabean markets down yesterday, closing at €550.25/t, down €3.25/t over the session.

EU 2023/24 grain outlook

While so far this season much of the focus has been on news surrounding the Black Sea region and Southern Hemisphere production, as we move through the rest of the marketing year, grain markets will turn their focus increasingly to the development of Northern Hemisphere crops. So, what do we know about 2023/24 EU grain production so far? And how might this influence European and potentially domestic prices going forward?

Output expectations

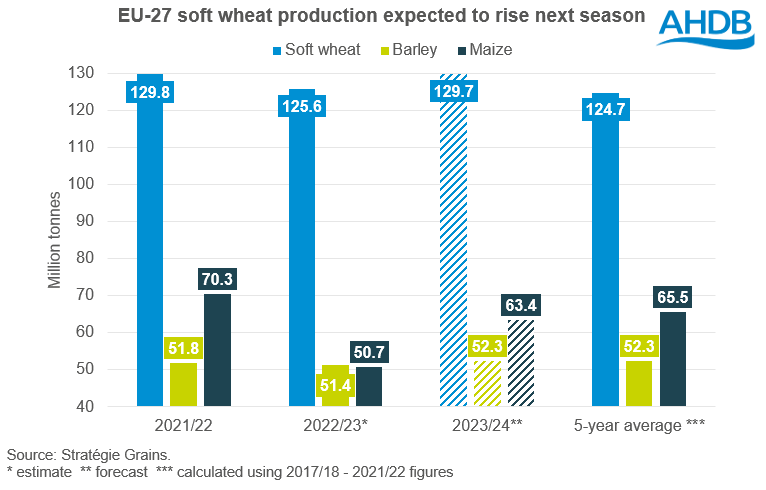

Last week, consultancy firm Stratégie Grains released their monthly EU grain report. For the second month in a row, it raised its EU soft wheat production forecast, now pegged at 129.7Mt, up 0.3% on the previous month’s estimate. If realised, this would also be up 3.3% (4.1Mt) on the year, and up 4.0% on the five-year average.

Last week’s report saw an unchanged barley figure, still forecast at 52.3Mt, up 1.8% on the year, but unchanged from the five-year average. Finally, next seasons maize production was pegged at 63.4Mt, revised down from the previous month’s estimate of 63.8Mt. However, the revised figure is up 25% (12.7Mt) from this season, unsurprising given the poor conditions for the development of the maize crop in Europe this year.

Generally, with a mild start to winter, crop conditions have been positive. However, soil moisture deficits could be a cause for concern moving forward, particularly in regions that experienced severe drought last year. While in Spain and Italy soil moisture is higher now than at the same point last year, in France and Germany, levels are at 6-year lows (Refinitiv).

Latest forecasts also suggest that Europe will experience warm and dry weather in the upcoming week, with temperatures exceeding average values even in northern parts of the region. Moving forward, abnormally warm and dry weather could continue to push crops out of winter dormancy leaving them vulnerable to early spring frosts and eventually impacting yield (Refinitiv), something to monitor over the next few weeks.

What does this mean for next season's exports?

While European wheat and barley exports continue to face competition from competitive Black Sea supplies this season, next season export forecasts are due to rise. Much like in our domestic market, limited competitiveness on the global market, combined with reduced demand from the animal feed sector, is expected to leave the EU with large wheat ending stocks in the 2022/23 season. Combined with a forecast large new wheat crop (harvest 2023), the EU is forecast to have lots of grain to export next season, and with anticipated declines in Russian and Ukrainian grain production the demand could be there for more EU wheat.

Currently, wheat exports for 2023/24 are estimated at 30.6Mt, revised up from 30.2Mt in the previous month’s estimate, and up 0.5Mt on the year. Maize exports (2023/24) are predicted to be up 1.5Mt on this seasons estimate, at 4.2Mt. Finally, barley exports for next season are pegged at 6.9Mt, up just 0.1Mt on the year, as Chinese demand for French barley in particular has remained strong this season.

With increased exports expected from the EU next season we could see some pressure on continental prices longer term, which in turn is a watchpoint for domestic prices. However, it is still very early to predict how next seasons continental supply and demand balance will look, and weather and its impact on crops will be the greatest watchpoint over the next couple of months.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.