Egyptian wheat demand is paramount for markets: grain market daily

Wednesday, 10 February 2021

Market Commentary

- Old crop UK wheat futures (May-21) closed yesterday at £202.90/t, down £0.20/t on Monday’s close. New crop futures were pressured further closing down £0.75/t at £166.35/t.

- Pressure on our domestic price was due to lower global wheat markets as Chicago wheat and Paris milling wheat contracts closed down.

- This was due to the latest USDA WASDE report reducing its forecast of US maize stocks less than market expectations. World (less China) ending stocks are forecast to be 90.4Mt, down from 92.2Mt in the January report. Further to that, global imports of maize are revised up 2.7Mt far less than market expectations.

- Global ending stocks were also reduced for wheat as global feed increase, notably for China, increasing 5.0Mt on January’s report.

Egyptian wheat demand is paramount for markets

Strategic reserves of wheat in Egypt are built by the General Authority of Supply Commodities (GASC) who issue tenders when supplies are required.

With Russia set to impose a tax starting next week to last for the rest of this marketing year, Russian export prices will face competition from nearby exporters such as the EU for this trade.

In the latest GASC tender French wheat was $293.75/t (FOB), while Russian was higher at $295.80/t (FOB).

With the UK currently trading at import parity, extra demand from the MENA region for European supplies could maintain support for continental prices or temper pressure. This will filter into our domestic market.

The EU is forecast to export 26.6Mt of wheat (common and durum) to third countries in 2020/21. With 15.1Mt exported as of 31 January, there is capacity to supply to third countries for the second half of the marketing year.

Egyptian situation at the moment

Until the start of February GASC hadn’t purchased any wheat since December. However, as prices have been increasing, they were forced to make a big purchase of 480Kt at start of February.

GASC stated that their strategic reserves are sufficiently covered until July 31. Further to that, their local harvest is expected to start mid-April.

With the USDA forecasting that Egypt is expected to import 13.0Mt of wheat this season, the import and tender data that is public suggests that Egypt will still have to purchase wheat for the rest of the 2020/21 marketing year.

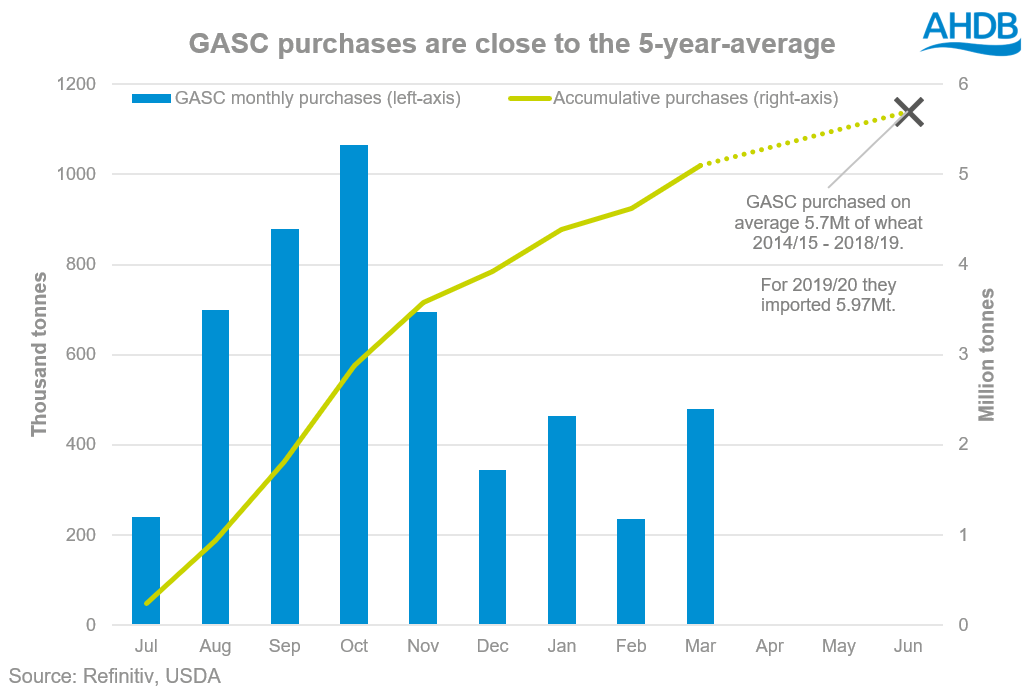

For the 2020/21 marketing year GASC have purchased 5.1Mt from to July to March (Refinitiv), Russian origin accounts for c.80% of these tenders.

With GASC purchasing 5.7Mt on average over a marketing year. This suggests that there probably is some purchases still required, but the majority will be private bookings to fulfil their import requirement.

What does this mean for a domestic grower?

Egypt requiring supplies and the Russian export tax means that Europe may possibly be competitive for future GASC tenders or private requirements, due to their geographical location.

This will maintain support or even subdue the pressure on continental grain markets if Europe were to supply Egypt with wheat for the second half of the year. The USDA even reduced EU wheat ending stocks down 0.5Mt to 10.6Mt in their latest report. So we are heading for a tight end of season for EU markets and further Egyptian buying could exacerbate this.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.