Early Bird Survey, data we can trust: Grain Market Daily

Tuesday, 23 November 2021

Market commentary

- UK wheat futures (May-21) closed yesterday at £239.80/t, gaining £6.30/t on Friday’s close and setting yet another contract high.

- The November-22 closed yesterday at £210.00/t, gaining £5.00/t on Friday’s close. Meanwhile, the November-23 contract closed down £0.50/t yesterday, at £188.50/t.

- Nearby Chicago wheat futures climbed to a 9-year-high yesterday. Rising Russian prices with the floating tax are keeping the market bullish.

- This is also combined with rains in Australia, which are slowing harvest and compromising quality. Together, these factors have provided the fresh news for this market to keep climbing.

Early Bird Survey, data we can trust

The Early Bird Survey (EBS), released last Friday, showed wheat, winter barley & oilseed rape areas could increase for harvest 2022. Meanwhile, the area of other major crops, such as spring barley and oats, reduced.

This survey is part-plantings and part-intentions, so some crops are not sown yet. The EBS covered 630Kha this year, representing 13% of the total area of the crops surveyed.

With successive years of EBS publications this data & analysis has stood the test of time. For the most part it is not too dissimilar to the final Defra figures, which are released 13 months after the EBS’ provisional publication.

Early Bird Survey vs Defra final

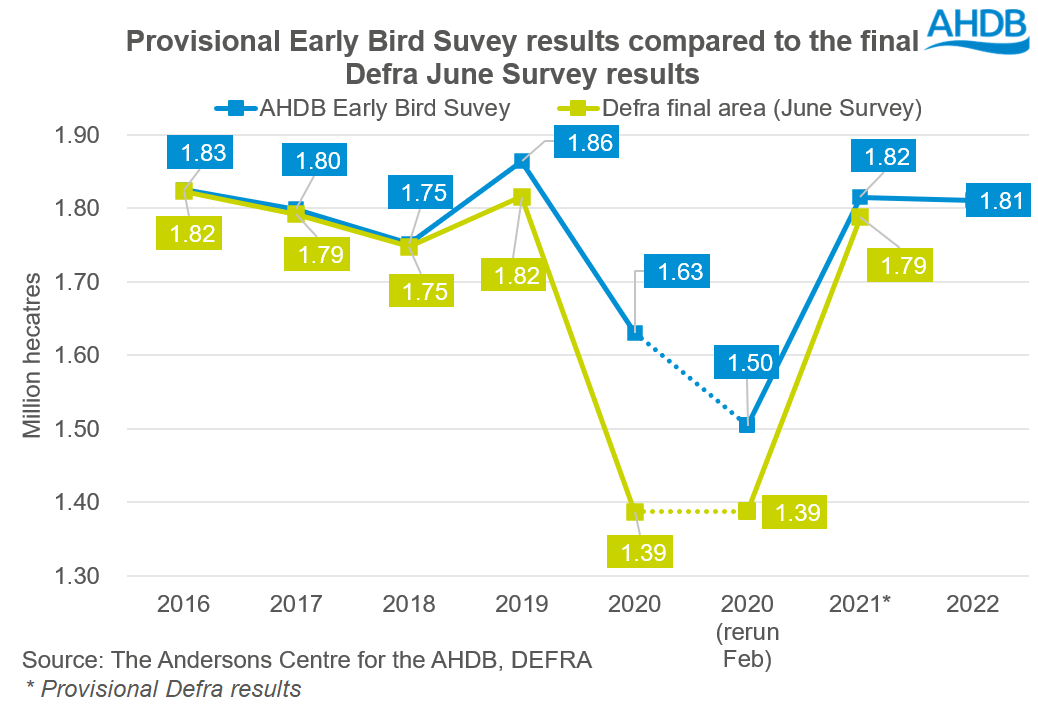

In this analysis I have taken the provisional wheat area results and compared them against the Defra final areas going back to 2016. I have also included the re-run of the survey we did in February 2020. The survey ran twice that season as the very wet Autumn hampered winter cropping and impacted the results.

As we can see in the graph, the provisional EBS wheat area estimates are similar to the final Defra results. Excluding 2020, there has only been a maximum difference of 48Kha from provisional EBS to final Defra results.

Between 2016 – 2021, with the seven surveys conducted there has only been a 4.4% difference from the final Defra result. The main driver of this difference is the first EBS undertaken in Autumn 2019. That survey estimated the wheat area at 1.63Mha, a 17.6% difference from the 1.39Mha in Defra’s final result.

However, the re-run estimated the area at 1.50Mha, 8.4% different from the final figure. The data collection for this was only up until 14 February 2020. Therefore, it seems like not all spring wheat intentions were planted for harvest. There’s more detail which can be found in this report.

If we exclude the first EBS in 2019 and use the six surveys between 2016 – 2021, the difference from Defra’s figures reduces to 2.2%.

Yield is key to production

With the area cover in this survey, we can have a high degree of confidence that our wheat area will sit in this region. Using the EBS area of 1.81Mha, it means that based on a 5-year-average yield our production could be 14.4Mt.

If we apply 5-year-low and 5-year-high yields to the area, we can expect a crop between 12.6 – 16.2Mt. This shows that production is largely dependent on parameters out of our control, i.e. the weather.

Conclusion

To conclude, the EBS is a timely piece of information that gives a first insight into what wheat crop the UK could produce for the 2022/23 marketing year.

The EBS variation from Defra is higher in extreme weather years. But so far this year hasn’t posed any extreme weather.

There are two main factors that could change these intentions from now until 2022 harvest:

- The rising cost of fertiliser could shift intentions in spring to less nitrogen intensive crops, if rotation allows. But a lot of wheat is winter sown, so we probably won’t see much of a change in wheat cropping. But be sure to check out our latest tool: Nitrogen fertiliser adjustment calculator for cereals and oilseeds.

- The final point is the weather could still impact spring cropping intentions, but this will not have much impact on winter barley, wheat and OSR.

The AHDB Planting & Variety Survey will provide further clarification into the harvest area. This survey is scheduled to be released in July 2022, just before harvest.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.