Domestic wheat demand in decline: Grain Market Daily

Friday, 4 October 2019

Market Commentary

- Following Monday’s jump in US maize futures, prices have tracked sideways. Further support could well come from next week’s USDA WASDE, where a possible reduction in yield forecasts would provide additional support.

- European prices have pushed slightly higher, with gains in Paris maize futures amid poor yield outlooks, providing support to Paris wheat futures.

- However, with a strengthening of the euro against the dollar, some of the additional support from US stocks may well have been minimal.

- UK feed wheat futures (Nov-19) have drifted lower during the week. Prices have fallen £1.40/t from Monday’s high, to close yesterday at £137.60/t.

Domestic wheat demand in decline

With the largest wheat crop to have been harvested since 2015/16, the UK is certainly in a surplus position for 2019/20.

Yet, although the UK is facing a greater supply, and pricing competitively against European origins, domestic demand so far in 2019/20 has reduced, potentially adding to the export requirement for 2019/20.

GB Animal feed production statistics recorded usage of feed wheat for July and August to be down 6% year-on-year, and the smallest tonnage since 2015/16. Further, good grass growth for silage may continue to reduce the overall compound feed requirement for cattle herds.

Additionally, wheat usage in the flour, milling and industrial industry is down during the months of July and August. Wheat milled totalled just 883.1Kt, 20% down year-on-year and the smallest tonnage milled since 2004/05.

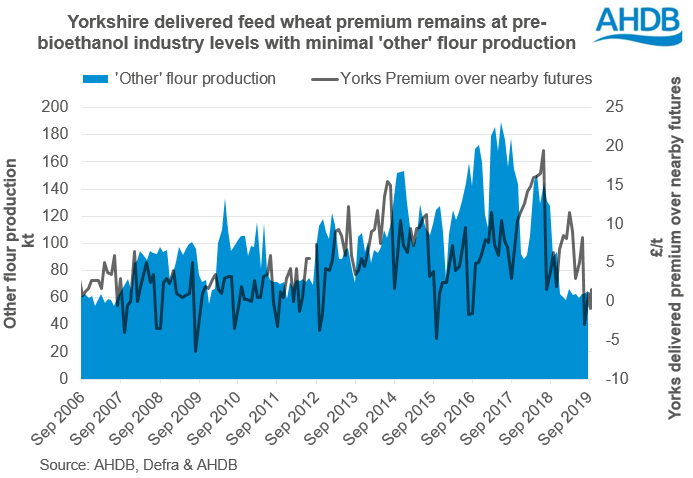

The reduction in wheat usage by the Human and Industrial sector is, in part, due to a reduction of ‘other flour’ production, which covers much of the industrial usage sector, including ethanol production.

‘Other flour’ produced during July and August is down 54% year-on-year, and the smallest volume since 2007/08. At just 40% of the ‘other flour’ produced in 2016/17 and 2017/18, production in 2019/20 is back at pre-Ensus and Vivergo days.

The lacking industrial demand for wheat in the North East has reduced the physical market delivered premiums.

The price of feed wheat delivered to the Yorkshire region in 2019/20 has been at a minimal premium to UK feed wheat futures, and back to similar premiums recorded prior to the North East bioethanol industry.

Further, the minimal premium for feed wheat delivered to Yorkshire above futures continued throughout September. The little stretching of the premium on quotes for forward sales, indicates that demand, and expectation of demand, has remained minimal.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.