Do futures represent the market? Grain Market Daily

Friday, 17 July 2020

Market Commentary

- UK wheat futures (Nov-20) closed yesterday at £168.75, down £0.95/t on the day, but up £0.25/t on the previous week.

- China shows high demand for US grains and soybeans. According to Reuters, China has bought 3Mt of US maize since July 10, helping to support US futures markets. Consultants Agritel have suggested Chinese purchases could increase further based on current prices.

- Poor weather conditions have limited Russian harvest forecasts. After cuts in Russian wheat production estimates earlier in the week from both IKAR and SovEcon, the two leading Russian agri-consultants. Whilst Russia is still expected to be on track for an average harvest overall, crop conditions have suffered adversely both in June and the first few weeks of July.

Do futures represent the market?

With a small UK crop and an uncertain trading environment post-December, price transparency is more pivotal than ever. Looking at the current carry in the futures market, the spread between Nov-20 and May-21 is just £4.50/t.

The open interest on the May-21 contract is small at present, with the market pricing off November as we enter an uncertain production year. It’s worth nothing that a small carry between November and May will make it difficult for those looking to roll November futures positions forwards to May. Most would account for a £1 per month carry to switch positions which isn’t quite there yet at these early stages of the season.

The lack of futures carry is arguably not representative of the current market. The market is short of wheat and as such it should be pricing to draw wheat out in the short-term, prices are doing this. Following this, we would expect to see the May-21 value stretch in order to increase the attractiveness of holding wheat into the latter half of the season.

The delivered market is currently signalling a bigger carry from Nov-May, with the carry between East Anglian feed wheat for Nov and May delivery quoted last week at £7.00/t. During the tight 2013/14 season, the carry between Nov and May extended to a similar level, reaching £7.00/t in September 2013.

UK futures fail £170/t test again

Nov-20

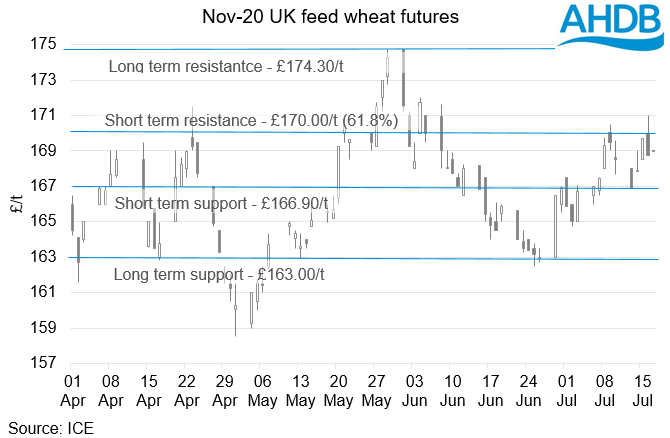

Yesterday UK feed wheat futures (Nov-20) tried and failed to break the £170.00/t mark again. Domestic markets have been following the global rally in response to a tightening global picture.

The £170.00/t mark sits at 61.8% Fibonacci retracement between the recent high of £174.30/t (achieved 29 May) and the £163.00/t low (26 June). If futures were able to break this level then the next resistance is arguably at £174.30/t. Should futures continue to struggle to close above the lower mark, then moving back toward the support at £166.90/t seems plausible.

Nov-21

Nov-21 futures, have similarly pushed higher in recent weeks and had been testing the 61.8% Fibonacci retracement level at £154.33/t. The Nov-21 market closed marginally above this retracement level yesterday at £154.35/t.

Despite reaching a high £155.00/t during trade yesterday, the contract was unable to maintain momentum to the close, falling back with only £0.10/t between the open and the close. The next resistance level sits at £156.85/t, should the move above £154.33/t be sustained.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.