Delivered premiums in the North feeling pressure for 2021/22? Grain market daily

Tuesday, 5 January 2021

Market commentary

- UK wheat futures (May-21) closed yesterday at £202.60/t, gaining £1.60/t on last Thursday’s close. New crop (Nov-21) also gained £1.35/t to close at £164.85/t.

- Global fundamentals are currently driving domestic gains. Dry weather in South America and an export suspension on Argentinian maize until the end of February is leading to uncertainty on maize and soyabean supplies coming out of the continent. The firming of maize as a result is supporting wheat prices.

- Chicago maize futures (May-21) closed yesterday at $190.61/t, this contract climbed by 12.65% throughout December.

Delivered premiums in the North feeling pressure for 2021/22?

The release of the regional breakdown of the Early Bird Survey can help us provisionally forecast what the 2021/22 marketing year may entail for delivered premiums of milling and feed wheat.

The size of the potential crop from the East of England against regions further north can start to provide some insight into the size of incentive needed to haul grain up the country, to fulfil any deficit.

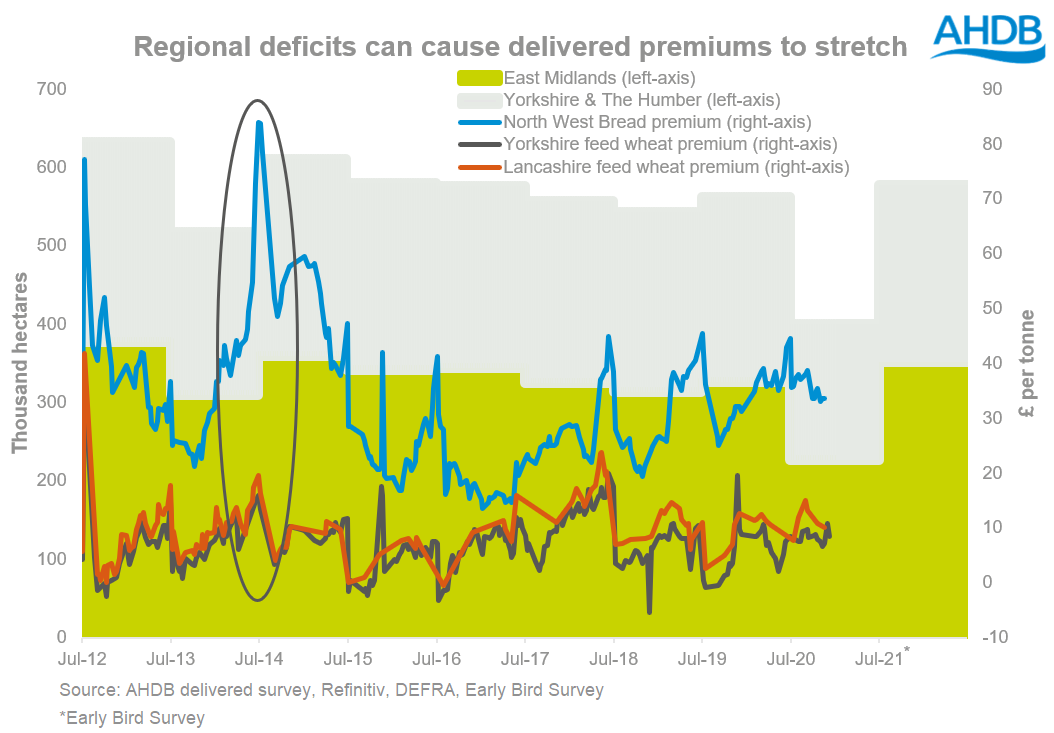

The two key regions that could determine how far delivered premiums stretch from the East of England are the East Midlands and Yorkshire & The Humber.

In years of higher production levels, these regions will also fulfil demand from the North, supplementing supplies from the East. With less distance to travel, delivered premiums could be capped.

The 2021 EBS has forecast a wheat area rebound for both these regions from last season – by 55% for the East Midlands and 31% for Yorkshire & The Humber. Should these areas be realised, they would be the largest since 2014 and 2015 respectively, following a season where weather significantly impacted the wheat area, and would account for a third of the GB wheat area.

How far can delivered premiums stretch?

While it is important to remember that there are other parameters that can effect delivered premiums, such as imports and bio-ethanol demand in the North of England, the regional planted area for that marketing year can impact how far premiums stretch.

We have seen this in previous seasons where a lower wheat crop has been realised. The above graph shows the bread premiums stretched to £83.80/t in the 2013/14 marketing year, following reduced wheat production (11.9Mt) which had suffered a disrupted planting window.

However, throughout the 2014/15 marketing year when planted wheat area recovered, premiums progressively subdued throughout the marketing year.

So, with wheat areas looking to rebound for the 2021/22 season, we may start to see pressure being applied to delivered premiums. However, demand is also key to driving the premiums, so any activity in bioethanol demand or import availability will affect the available supply and therefore any gained premiums.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.